8 BEST Options Trading Courses (2026)

Options Trading can be used to hedge your portfolio, short stocks and leverage your bets to earn higher returns with lesser investments. You may use Delta neutral strategies to earn money irrespective of the market direction.

Options trading courses help you learn Options trading in depth with its bearish/bullish strategies, risk management, etc. Learning Options Trading helps you participate skillfully in the world of trading. You will also have more chances of higher returns, learn how to trade with less investment, land trading jobs, and much more.

After spending over 110 hours testing and reviewing 45+ photo viewer tools, I have handpicked the best options for Windows. This in-depth analysis focuses on the most trusted features, pros, and cons, including both free and paid solutions. With transparent breakdowns and well-researched pricing, this guide aims to offer insightful advice for users at any experience level.

Best Options Trading Courses (Learn Option Trading)

| Course Name | Provider | Duration | Difficulty | Rating | Link |

|---|---|---|---|---|---|

| Option Alpha | OptionAlpha | 14 Hours | Beginners to Advance | 4.8 | Learn More |

| Investor and Financial Investment education | T.D. Ameritrade | Self-made | Intermediate | 4.6 | Learn More |

| The Complete Foundation Stock Trading Course | Udemy | 9.5 Hours | Introductory | 4.5 | Learn More |

| Derivatives Options & Futures | Coursera | 16 hours | Intermediate | 4.5 | Learn More |

| Options Trading Course | bullish BEARS | Self Paced | Beginners | 5.0 | Learn More |

1) Learn how to Trade (Option Alpha)

Best for beginners to understand Options Trading

Key Specs: Rating: 4.8 | Duration: Total 14 Hours | Level: Beginners to Advance | Fee: Lifetime free course | Certificate: No

Option Alpha is a reliable and user-friendly course platform I checked during my research. It offered me a refreshing perspective on learning options trading without added costs. Its Free Courses are perfect for traders who want to level up their skills without jumping into expensive programs. I suggest this platform for those who prefer a structured yet flexible approach. The best way to get started is by simply following their beginner-to-advanced path. During corporate finance bootcamps, trainers are now incorporating Option Alpha modules to teach risk-managed trading methods in a simplified way. This course is created by Kird Du Plessis, founder of Option Alpha. He loves finance and has a B.S. degree in Finance from the reputed University of Virginia, McIntire School of Commerce.

This comprehensive options trading course begins with foundational knowledge, teaching beginners the basics of Options Contracts and essential strategies for small accounts. Intermediate learners explore differences between historical and implied volatility, learn stock scanning techniques, and develop a daily routine. Advanced lessons focus on mitigating Black Swan risks.

What Will You Learn?

- Options Contract Basics: Options contracts are agreements that give you the right to buy or sell an asset at a set price within a specific time frame.

- Stocks vs Options Trading: I realized stocks typically involve direct ownership, whereas options trading allows you to profit through strategic positions without owning the asset directly.

- Options Contract Specifics: An options contract typically defines the strike price, expiration date, and whether it is a call or a put option—these are essential details.

- Generating Income with Options: Selling covered calls is one of the most effective strategies that allows you to earn regular premium income from existing stock positions.

- Market Prediction Techniques: Understanding implied volatility and technical indicators is a great way to estimate market direction and plan your options trades accordingly.

- Choosing the Right Strategy: You need to consider your risk appetite, market outlook, and time horizon in order to select the most effective options trading strategy.

Pricing

Free to Enroll

How to Enroll in the Option Alpha Course?

- Step 1) Visit the Option Alpha courses page at Option Alpha Courses.

- Step 2) Connect your TradeStation or Tradier Brokerage account to gain free access to the courses.

- Step 3) Start learning the courses on options trading by diving into the course content.

Pros

Cons

Link: https://optionalpha.com/courses

2) Investor and Financial Investment education (T.D. Ameritrade)

Best for learning Technical analysis.

Key Specs: Rating: 4.6 | Duration: self-made | Level: Beginner to Intermediate | Fee: Lifetime free | Certificate: No

Investor and Financial Investment education is a superior choice for anyone aiming to master options trading. I particularly liked how it blends real-life scenarios with core investment principles. In the course of my review, I could access interactive content that enhances understanding without jargon. It is important for learners to stay updated, and this curriculum does just that with market-driven content. Retail investors often say this curriculum helps them decode market moves and improve their decision-making before placing trades.

It teaches how to trade, technical analysis in investment basics, mapping the exit and entry points, etc. With T.D. Ameritrade, you will learn how to use technical analysis for your benefit. This will also help you identify future trends, craft entries, price movements, etc. Offers a comprehensive learning experience, including moving averages to identify trends, expert advice on selecting stocks, and AI-powered content for personalized education. These courses feature free workshops, seminars, and webcasts, where you can learn financial strategies from seasoned professionals.

What Will You Learn?

- Getting Started with Options: You will understand the core concepts of options trading, including calls, puts, strike prices, and how options typically work in markets.

- Technical Analysis for Beginners: I used basic charting tools and candlestick patterns to analyze price trends, which helped me identify better entry and exit points.

- Avoiding Common Investing Mistakes: You will learn the most effective ways to avoid emotional decisions, overtrading, and poor diversification in order to minimize risk exposure.

- Investing at Market Highs: You will explore strategies that help you manage volatility and avoid major losses when investing during stock market highs or peak cycles.

- Basics of Futures Investing: You will learn how futures contracts work, what margin requirements are typically needed, and how they function as a price hedge in markets.

- Leveraging Capital with Futures: I used futures contracts as a great way to increase market exposure, which allowed me to amplify returns with limited upfront capital.

Pricing

Free to Enroll

How to Enroll with Investor and Financial Investment education?

- Step 1) Visit the Schwab website.

- Step 2) Look for the “Sign Up” or “Open an Account” button on the homepage.

- Step 3) Provide the necessary details such as your personal information, contact details, and any specific preferences you might need for your account.

- Step 4) Complete the security verification steps to ensure your account is set up securely.

- Step 5) Once your account is created, you can begin exploring Schwab’s offerings and services.

Pros

Cons

Link: https://www.schwab.com/welcome-to-schwab

3) The Complete Foundation Stock Trading Course (Udemy)

Best for understanding the Stock Market

Key Specs: Rating: 4.6 | Duration: 9 hours 29 minutes | Level: Beginner | Fee: $39 for lifetime access | Certificate: Yes

The Complete Foundation Stock Trading Course has been a valuable addition to my learning toolkit. I tested its content thoroughly and found it to be remarkably structured for anyone starting in trading. It simplifies complex stock market concepts and teaches everything from short-term trading strategies to long-term investment planning. I was impressed by how well it covered technical analysis and the role of exchanges like NASDAQ and NYSE. It is a great way to build confidence before placing your first trade. Small business owners often rely on this course to make informed decisions when diversifying their income through stock investments.

This comprehensive course offers an in-depth understanding of the stock market, including its evolution, technical analysis, and money management strategies. Learn to navigate risks, manage portfolio positions, and master short selling. With 9.5 hours of on-demand video, articles, and downloadable resources, this course ensures you gain valuable insights from professional traders.

It is created by Mohsen Hassan and the Bloom Team. Mohsen is the founder of Bloom Trading, as he is passionate about finance and enjoys teaching. The Bloom Team provides support for Bloom Udemy students to help them understand all the educational materials.

What Will You Learn?

- Core Market Fundamentals: You will learn how the market functions, how prices are determined, and what drives trading activity across different financial instruments.

- Chart Analysis & Indicators: You will discover the most effective techniques for identifying support-resistance levels, trendlines, and momentum through technical indicators.

- Managing Capital & Risk: You will learn the best way to safeguard your capital by defining position sizes, using stop-losses, and setting risk-reward ratios.

- Mindset for Trading Success: It might be helpful to develop psychological discipline to stick with your trading plan and avoid impulsive decision-making in volatile markets.

- Tools & Trade Monitoring: You will get familiar with platforms that help you place trades, monitor performance, and use built-in analytical tools for better decisions.

- Recommended Reading List: This section provides essential reading suggestions and learning aids to help you become more proficient in trading strategies.

- Bonus Session Highlights: You will receive extra guidance through bonus lectures that offer additional strategies and helpful resources to sharpen your trading knowledge.

Pricing

$5.77 for a course

How to Enroll in Complete Foundation Stock Trading Course?

- Step 1) Head over to the Foundation Course for Stock Trading on Udemy.

- Step 2) Tap the “Enroll Now” button to start the enrollment process.

- Step 3) Create an account on Udemy if you don’t have one, or log in if you already have an account.

- Step 4) Complete the payment process, if applicable, and start your learning journey with this course.

Pros

Cons

4) Derivatives Options & Futures (Coursera)

Best for learning Options strategies and mechanics of Futures Market

Key specs: Rating: 4.5 | Duration: 16 hours | Level: Intermediate | Fee: Lifetime free | Certificate: Yes

Derivatives Options & Futures (Coursera) became one of my top picks while reviewing courses for the BEST Options Trading Courses. I was able to see how clearly it explains the working of future markets, the role of margin in risk management, and the value of understanding contango and backwardation in real trading scenarios. Finance graduates often opt for this course to get a better handle on contract settlements and build a strong base before moving to live trading platforms.

This options trading course provides comprehensive insights into the roles and responsibilities of buyers and sellers, teaching trading mechanics in future markets. Students analyze stock option pay-off charts to determine profits, losses, and break-even points. With hands-on Coursera labs and flexible deadlines, learners can also earn a sharable certificate.

This course is taught by five instructors. Andrew Wilkinson, a director of trading education, Jeff Praissman, a senior trading education specialist, and Mary MacNamara, a project manager and digital media producer. It is also taught by Luca Deaver, a media art director, and Steven Levine, a senior market analyst.

What Will You Learn?

- Options Fundamentals: You will learn how options function, the role of strike prices, premiums, and how market dynamics influence their pricing behavior.

- Options Market Mechanics: I was able to see how trading volume, liquidity, and open interest are essential components of an active options market.

- Basic Option Strategies: You will learn strategies such as covered calls and protective puts, a great way to start minimizing risk in market exposure.

- Neutral Market Strategies: You will learn how strategies like iron condors or straddles aim to profit from sideways price movement with limited directional risk.

- Futures Market Mechanics: You will learn how the futures market functions, including contract specifications, leverage use, and role in hedging price risks.

- Advanced Option Strategies: You will learn more sophisticated approaches such as spreads, strangles, and butterflies, which help fine-tune risk and reward across varying market conditions.

- Risk Management Techniques: You will understand how to manage risk effectively using tools like the Greeks, stop-loss orders, and position sizing to protect your capital and optimize returns.

Pricing

Free to Enroll

How to Enroll in Derivatives Options & Futures Course?

- Step 1) Visit the Derivatives – Options & Futures course page on Coursera.

- Step 2) Click on the “Enroll for Free” button. You will need to either sign in with your existing Coursera account or create a new one using your email.

- Step 3) Start the course and begin exploring the content, which covers futures markets, options trading, risks, margin requirements, and more. You can also open a demo trading account for hands-on practice in a simulated environment.

Pros

Cons

5) Options Trading Course (Bullish Bears)

Best for learning how to become an independent Options Trader

Key Specs: Rating: NA | Duration: Self-Pace | Level: Beginners | Fee: $47 per month | Certificate: No

Options Trading Course by Bullish Bears stood out when I tested different learning paths in options trading. The course structure is intuitive and walks you through the most effective strategies without overwhelming jargon. It covers all you need to know about spreads, the Greeks, and option probabilities in an easy manner. I particularly liked how it presented credit spreads and iron condors — essential techniques for sideway markets. It is important to learn these with real examples, and this course delivers that. These days, young professionals are relying on this course to start passive income streams through smart options selling strategies.

This course provides recorded live options trades for over 1.5 hours, helping you gain a clear understanding of options trading and foundational knowledge. You’ll master spreads, including credit and debit spreads, while learning day trading and swing trading techniques. Exclusive access to trade rooms, live streams, and real-time strategy learning ensures a safe and effective trading experience, with advanced concepts like OCO incorporated.

You will also understand the probability of OTM, vertical spreads, trading spreads, and much more. The provider of this course is Bullish Bears, a pay-it-forward trading community, and you will learn this course from their trading experts and get access to real case studies and examples.

What Will You Learn?

- Selling Options Basics: You will learn the fundamentals of selling options, including how call and put selling works for generating consistent income.

- Sell a Call and a Put: I found that selling a call and a put allows you to create income strategies by controlling option positions and collecting premiums.

- Vertical Spreads & Assignment: You will learn how vertical spreads help limit risk and how options assignment works in different market conditions.

- Credit and Debit Spreads Strategies: You will learn essential strategies using credit and debit spreads, which are great for limiting risk and maximizing reward potential.

- Day vs Swing Trading Options: You will learn the key differences between day trading and swing trading options, which helps you choose the most effective approach.

- Weekly Options Trading: You will learn how weekly options are a great way to capture short-term gains and manage quick price movements effectively.

Pricing

Plan start at $47 per month

How to Enroll in Options Trading Course?

- Step 1) Head over to the Options Trading Course page on BullishBears.com.

- Step 2) Scroll down and click on the “Enroll Now” button.

- Step 3) Create an account by providing your email address or log in if you already have an account.

- Step 4) Start learning and exploring various strategies like credit spreads, iron condors, and more.

Pros

Cons

Link: https://bullishbears.com/options-trading-course/

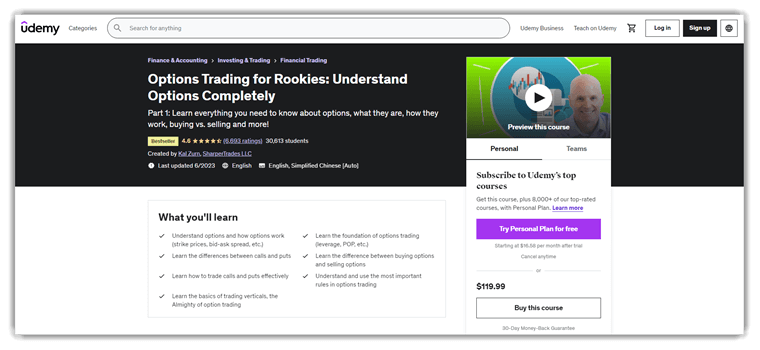

6) Options Trading for Rookies: Understand Options Completely (Udemy)

Best for learning all the basics in Options Trading

Key specs: Rating: 4.7 | Duration: 2 hours 39 minutes | Level: Beginners | Price: $19 for lifetime access | Certificate: Yes

Options Trading for Rookies impressed me with its down-to-earth teaching style. During my analysis, I found that the course is perfect for those who are curious about the buying VS selling concept. It explains technical terms with ease and shows how leverage can work in your favor. I recommend it if you want a stress-free way to get started in trading. The flow of the lessons makes learning enjoyable and practical. It is one of the most engaging options in 2025. Freelance finance educators are using this course to create supplementary content for their own audience, thanks to its simplified approach and reliable knowledge base.

This options trading course covers the fundamentals, including the rules and workings of stock options. It offers 2.5 hours of on-demand video, an article, and four downloadable resources. With lifetime access via a one-time purchase on T.V. and mobile, you’ll earn a certificate, debunking common myths about trading complexity. Group subscriptions are available for corporate upskilling.

This course is created by Kal Zrun, the founder of Options Trading for Rookies and a successful options trader who brings his 10 years of experience as an instructor. It is also created by ShaperTrader LLC, which is a leading educational institution in online trading.

What Will You Learn?

- Introduction to Options Trading: You will understand the basics of options trading, how the market operates, and the benefits it typically offers to investors.

- Defining Options: I previously learned that options are financial contracts that allow you to buy or sell assets at a pre-agreed price by a set date.

- Options VS Stocks: You will grasp the key differences between trading options and traditional stocks, which helps you make better investment decisions.

- Call and Put Options: You will explore how call and put options work, which are essential for making strategic trades based on market direction predictions.

- Opening and Closing Process for Options: You will learn the complete steps involved in entering and exiting options positions, which is one of the most effective trading practices.

- Vertical Options: You will discover how vertical spreads function and why they are a great way to limit risk while maintaining profit potential.

Pricing

$6.77 for a course

How to Enroll in Options Trading for Rookies?

- Step 1) Head over to the course page Options Trading for Rookies

- Step 2) Click on the “Buy Now” or “Add to Cart” button, depending on your preference.

- Step 3) Sign in to your Udemy account or create one using your email.

- Step 4) Proceed with payment or apply any available discounts if applicable.

- Step 5) Once enrolled, you can start learning by accessing the course content directly from your Udemy dashboard.

Pros

Cons

7) Derivatives, Futures, Swaps, and Options (edX)

Best for learning Options and Derivatives

Key Specs: Rating: NA | Duration: 6 weeks (1-2 hours per week) | Level: Beginners | Price: $250 for lifetime access | Certificate:No

Derivatives, Futures, Swaps, and Options (edX) is a solid learning course that I checked during my content review on financial education platforms. The material stands out because it makes complex trading concepts approachable. The course allows you to explore margin requirements and understand swaps with precision. I suggest this course to anyone aiming to build a strong trading foundation. It is important to choose a reliable source like edX when investing time in learning. These days, business schools are incorporating this course into their advanced finance curriculum to offer students practical exposure to trading instruments.

This comprehensive training offers expert instruction in six skill-building courses, covering Futures, Finance, Derivatives, Treasury, Interest Rate Swap, and Hedging. You’ll gain practical knowledge through individual and team projects, enhancing cognitive thinking and team management. A certification upon completion adds value to your professional profile on LinkedIn and Glassdoor. Additionally, corporate packages allow group subscriptions to help employees stay updated with the latest trends.

It also includes fundamentals of pricing interest rate Swaps, understanding Swaptions, and a review of different Option terminologies. This course is taught by Jack Farmer, an instructor at the well-known New York Institute of Finance, and Chris Thomas, an NYIF instructor at the same.

What Will You Learn?

- Introduction to Derivatives: You will learn the fundamentals of derivatives, including how they derive value from underlying assets like stocks or commodities.

- Basics of Futures and Forwards: Futures and forwards help you manage risk by allowing price locking in advance—great way to hedge against price fluctuations.

- Understanding Swaps: I found that swaps typically allow financial institutions to exchange cash flows or liabilities, especially to manage interest rate or currency risks.

- Essentials of Options Trading: You will explore options contracts, their pricing, strategies, and how they allow you to speculate or hedge efficiently in volatile markets.

- Exploring Options Strategies: You will learn key options strategies like covered calls, straddles, and spreads, helping you leverage market movements with limited risk while maximizing potential returns.

- Understanding Risk Management with Derivatives: This section will dive into the importance of using derivatives for risk management, illustrating how they can be used to protect investments or reduce exposure to market volatility.

Pricing

$275 for a course

How to Enroll in the Derivatives, Futures, Swaps, and Options Course on edX?

- Step 1) Head over to the Derivatives, Futures, Swaps, and Options course page on edX: Course Link.

- Step 2) Tap the “Enroll” button on the course page. You may be prompted to create an account or log in with your existing credentials.

- Step 3) Once enrolled, start your learning experience by accessing the course content directly through your edX account.

Pros

Cons

8) High Probability Options Trading Strategies (Alison)

Best for learning how to increase your earning potential

Key Specs: Rating: NA | Duration: 1.5 Hours – 3 Hours | Level: Intermediate | Price: Lifetime free | Certificate: No

High Probability Options Trading Strategies is a valuable course I tested while compiling this guide on options trading education. The content is broken down in a straightforward way, teaching how to trade straddles and strangles while also showing how to calculate the probability of profit using deltas. I found that this course is particularly great for beginners who want to avoid unnecessary jargon. It offered me a clear roadmap for using short calls and puts effectively. This may help learners grasp critical trading concepts faster and more confidently. Traders in training programs frequently refer to this course to enhance their skills in risk-based option selection and probability mapping.

This advanced Options Trading course covers strategies like strangles and straddles, providing real-world examples and case studies. It emphasizes understanding risk and rewards to maximize earnings potential. The course includes reading materials, quizzes, and practical tasks. Upon completion, you will earn a CPD-accredited certificate, enhancing your LinkedIn and resume.

It also teaches you the golden rules of trading and managing strangles, straddles, and more. This course is published by Kal Zurn, who is a successful Options trader and also a founder of Options Trading for Rookies. Kal has 10 years of experience and is also a co-instructor at SharperTraders.com.

What Will You Learn?

- High Probability Options Trading Strategies: You will be able to identify and apply high probability options trading strategies to improve your chances of consistent profitability in the market.

- Trading Strangles: I learned how to trade strangles, a strategy that allows you to benefit from significant price movements in either direction of the underlying asset.

- Understanding Straddles: Straddles were helpful to me as I learned how they provide flexibility in market movement, allowing traders to profit from volatility regardless of direction.

- Compute POP of Strangle and Straddle: I focused on calculating the Probability of Profit (POP) for strangles and straddles, helping me make more informed decisions with higher confidence.

- Methods of Reinforcing Strangles and Straddles Management: I found it essential to strengthen my skills in managing strangle and straddle positions using effective reinforcement techniques for better trade control.

- Process of Setting Up and Trading: Setting up and managing trades with clear guidelines was the most effective method for me to successfully implement options strategies.

Pricing

Free to enroll

How to Enroll in the High Probability Options Trading Strategies Course?

- Step 1) Head over to the High Probability Options Trading Strategies course page on Alison.

- Step 2) Tap the “Start Course” button to create an account or log in with your existing Alison account.

- Step 3) Once logged in, begin your learning journey by starting the course content.

Pros

Cons

Link: https://alison.com/course/high-probability-options-trading-strategies

How Did We Choose BEST Options Trading Course?

At Guru99, we are committed to providing credible and accurate information. Our editorial process ensures that all content is thoroughly researched and objective, delivering reliable resources to answer your queries. We have spent over 110 hours evaluating more than 45 photo viewer tools, selecting the best options for Windows with detailed insights into features, pros, cons, and pricing. Similarly, we carefully assess options trading courses, considering critical factors to provide a well-researched list of the best courses available. We focus on the following factors while reviewing a tool based on credibility, accuracy, and trustworthiness.

- Course Reputation: We chose based on the reputation of the course, considering user reviews and expert opinions.

- Expert Instruction: Our team made sure to shortlist courses that are taught by experienced, skilled traders and educators.

- Comprehensive Curriculum: The experts in our team selected courses based on their extensive, easy-to-follow course materials covering all aspects of options trading.

- Hands-On Training: We considered courses that offer real-time trading exercises, enabling learners to gain practical experience.

- Flexibility and Accessibility: We looked for courses that allow you to access content anytime, providing convenience to students of all schedules.

- Value for Money: The courses we chose ensure you receive the best content at a reasonable price, ensuring quality education without compromise.

Verdict

In this review, I have shared a list of some of the best options trading courses. After analyzing each one, I’ve crafted this verdict to guide your decision.

- How to Trade (Option Alpha): This comprehensive free course is ideal for beginners, offering clear lessons across all levels of options trading.

- T.D. Ameritrade: An excellent resource for mastering technical analysis and risk management, perfect for those looking to understand the market deeply.

- The Complete Foundation Stock Trading Course: A great choice for understanding the stock market, risk management, and technical analysis, with lifetime access for a one-time fee.