5 BEST Crypto Prop Trading Firms (2026)

Ever felt overwhelmed trying to pick the right platform to grow your trading journey? Choosing poorly can cost you more than capital. Hidden rules can quietly erode profits, delayed payouts choke cash flow, slippage eats entries and exits, scaling traps halt growth, data latency skews decisions, and unfair resets drain morale. Add in false promises and wrong tools, and you risk chasing shadows instead of building skills. The difference with quality firms is night and day—they provide clarity, structure, and a level field to help you grow sustainably.

I invested over 260 hours researching and testing more than 30 crypto prop firms firsthand. This article highlights the best 5 prop trading firms backed-by practical experience, covering their key features, pros and cons, and pricing in detail. If you are serious about choosing wisely, keep reading the full article. Read more…

Here’s my take on the best crypto prop trading firms based on my preferences:

Best Crypto Prop Trading Firms: Top Picks!

|

|

|

||

| Firm Name | Funded Trading Plus | Bitfunded | FundedNext | FTMO |

| Minimum Account Size | $5,000 | $10,000 | $6000 | $10,000 |

| Profit Share | Up to 100% | 50%-75% | Up to 90% | 80%-90% |

| Leverage | 1:100 | 1:100 | 1:100 | 1:100 |

| Supported trading platforms | MT5, Proprietary Platform | MT5, cTrader | cTrader, MT4, MT5 | MetaTrader 4, 5, DXtrade, cTrader |

| Link | Learn More | Learn More | Learn More | Learn More |

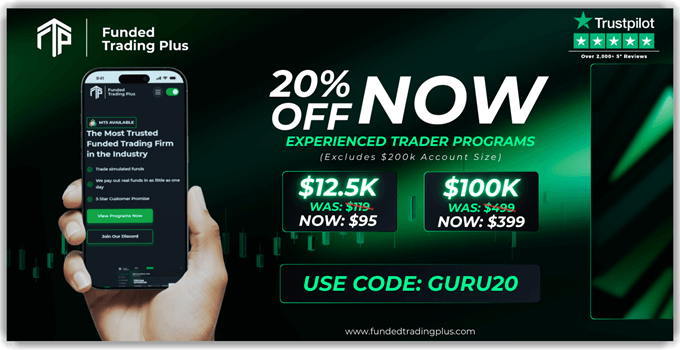

1) Funded Trading Plus

Funded Trading Plus offers a comprehensive, evaluation-based platform for cryptocurrency trading using firm capital with sophisticated risk management systems. Their multi-phase assessment process provides structure while the transparent profit-sharing model enables scaling earnings without personal financial risk. Traders can operate confidently across numerous crypto pairs, though the evaluation standards are rigorous and challenge phases demand sustained performance over lengthy timeframes.

Their social media channels consistently showcase support for traders through institutional-grade tools and equitable evaluation procedures—this approach feels authentic and matches real user experiences. While this commitment to legitimate opportunities is commendable, the assessment requirements and performance benchmarks may prove demanding for less experienced traders to maintain consistently.

Features:

- Multi-Phase Evaluation System: The structured assessment process demonstrates thoroughness and reliability. This multi-stage system enables traders to showcase consistent performance over extended periods. The comprehensive evaluation builds confidence that successful candidates are properly qualified, ensuring the firm maintains rigorous standards for funded trading accounts.

- Competitive Profit Sharing: The compensation structure offers exceptional value to traders. Participants can earn up to 90% of trading profits, representing one of the industry’s most favorable rates. This attractive profit split incentivizes consistent performance while maximizing earning potential for cryptocurrency traders.

- Comprehensive Crypto Coverage: The platform provides extensive access to cryptocurrency pairs and digital assets across the market spectrum. This broad selection allows traders to implement diverse strategies and capture opportunities throughout different crypto market segments. Coverage spans from established major coins to emerging altcoin opportunities.

- Professional Trading Infrastructure: The trading environment delivers institutional-quality performance and reliability. Advanced execution capabilities, live data streams, and sophisticated charting tools enable efficient trade execution and informed decision-making. Platform stability remains consistent even during periods of high market volatility.

- Risk Management Tools: Advanced risk control features provide comprehensive account protection. The system includes sophisticated stop-loss mechanisms, position sizing calculators, and drawdown protection protocols. These tools promote disciplined trading practices while safeguarding both individual accounts and firm capital.

Pros

Cons

Pricing:

Here are the Funded Trading Plus Challenge pricing options:

| Account Size | Minimum Trading Days | Daily Draw Down | Price |

|---|---|---|---|

| $5000 | None | 5% | $119 |

| $10000 | None | 5% | $199 |

| $25000 | None | 5% | $374 |

Profit-sharing Up to 100%

2) BitFunded

BitFunded provided a user-friendly, free-demo-based environment for trading Bitcoin and Ethereum using company capital and real-time analytics. I appreciated how the tools felt intuitive and the transparent access to leverage allowed me to scale without risking personal funds. I could trade confidently, but I noticed the fee structure was somewhat opaque and support responses lagged during peak hours.

Their Twitter feed (@Bitfunded160343) recently highlighted how they empower traders stuck in micro-accounts with capital and fairness—I found that refreshing and aligned with my experience. This talk of providing opportunities resonates, though the support speed and clarity around costs could use improvement to enhance trust and performance.

SWOT Analysis

Features:

- Instant Funding: I loved the instant funding feature. As soon as I passed their evaluation, I received my allocated capital within hours. This quick turnaround allowed me to start trading immediately, capitalizing on market opportunities without any delays. The seamless process really set BitFunded apart from other prop firms.

- Generous Profit Split: The profit split was incredibly generous. I received up to 90% of my trading profits, which was significantly higher than what most other prop firms offered. This motivating compensation structure encouraged me to perform at my best and maximized my earning potential as a trader.

- Trading Asset Variety: In my view, this is by far its biggest advantage. BitFunded offered an entryway to more than 100 different cryptocurrency pairs (irrespective of how popular or promising they are). This enabled me to pursue different trading strategies and benefit from opportunities in all ranges of the crypto market.

- Advanced Trading Platform: Their platform was a total game-changer. With real-time market data, sharp charts, and customizable tools, I could trade with ease and make informed decisions on the fly. It was simple, powerful, and totally streamlined my trading experience.

- Flexible Trading Rules: I appreciated the flexible trading rules. Unlike many prop firms with strict drawdown limits, BitFunded allowed for more breathing room. Their reasonable risk management guidelines struck a balance between protecting the firm’s capital and giving me the freedom to implement my trading strategies effectively.

Pros

Cons

Pricing:

Here are the BitFunded Challenge pricing options:

| Base | Starter | Intermediate |

|---|---|---|

| $5,000 | $10,000 | $25,000 |

Profit-sharing 50%-75%

3) FundedNext

FundedNext gives me fast access to capital with a 15 % profit share from the Challenge Phase. I felt empowered by their demo account, which helped me find my style without risking real money. I started earning quickly, especially trading Bitcoin and Ethereum short-term which felt quite impressive.

I saw on their X that “FundedNext Discord is now 200 K members strong”, which shows community strength. The challenge can feel daunting and their terms seem complex. Support works most of the time, but slow responses still impact momentum.

SWOT Analysis

Features:

- Flexible Trading Conditions: FundedNext offered me a diverse range of tradable instruments, leverage options, and competitive spreads. It allowed me to adapt my strategies to various market conditions.

- Streamlined Onboarding: The onboarding process was straightforward, with clear guidelines. Additionally, the user-friendly platform enabled me to start trading quickly.

- Funded Trader Program: FundedNext provided me with a funded account, allowing me to easily trade with their capital. I loved that I got to keep a cut of the profits – it was a huge motivator to keep pushing myself.

- Comprehensive Training: The platform offered comprehensive training resources, including educational materials and risk management tools. These resources helped me refine my trading approach and improve my overall performance.

- Trader’s Competition: FundedNext’s Trader’s Competition provided a platform for me to showcase my skills. It also allowed me to compete against other traders, which was a motivating and rewarding experience.

- Responsive Support: The FundedNext support team was readily available to address my questions and concerns. It ensured a smooth trading experience throughout my time with the platform.

- Diverse Cryptocurrency Options: FundedNext’s extensive selection of cryptocurrencies allowed me to diversify my trading portfolio. It also lets me capitalize on various market opportunities.

- Transparent Profit Sharing: The platform’s profit-sharing model was transparent, allowing me to clearly understand and track my earnings. This was a very important factor in my decision to use FundedNext.

Pros

Cons

Pricing:

Here are the FundedNext Stellar pricing options:

| Account Size | Get Plan Fee | Profit Target |

|---|---|---|

| $6,000 | $59 | P1: 8%, P2: 5% |

| $15,000 | €119 | P1: 8%, P2: 5% |

| $25,000 | €199 | P1: 8%, P2: 5% |

Profit-sharing Upto 90%

4) FTMO

FTMO is a crypto prop trading firm that simply delivers. I paid $155 once for their $10,000 funded account and sailed through two evaluation stages. Then I was trading Bitcoin and Ethereum on a sleek platform with rapid updates, crystal-clear transparency, and withdrawals that were anything but sluggish. I was blown away by FTMO’s seamless interface, lightning-fast market updates, and top-notch support team.

Withdrawals were quick and hassle-free, and I appreciated the transparency every step of the way. FTMO’s own X feed encourages traders to “Monetize your demo trading. Start your FTMO Challenge!”—a catchy call-to-action that matches the experience X (formerly Twitter). This is a free-spirit approach to professional funding for new crypto traders.

SWOT Analysis

Features:

- Evaluation Process: FTMO’s two-phase evaluation was challenging but fair. I had to demonstrate my trading skills and risk management over 10-30 days. Although it was stressful, passing the evaluation gave me confidence in my abilities.

- Profit Split: I loved FTMO’s 90/10 profit split, which favored me as the trader. This generous split motivated me to perform well, knowing I’d keep most of my profits.

- Trading Platforms: FTMO’s integration with MetaTrader 4 and 5 was seamless. I easily accessed various markets and executed trades efficiently. However, I wished they had more platform options.

- Customer Support: FTMO’s customer support was exceptional. The responsive and knowledgeable staff helped me resolve issues promptly. Their multilingual support team catered to traders worldwide.

- Withdrawal Process: Withdrawing profits from FTMO was straightforward and quick. I received my funds within 24-48 hours via bank transfer or cryptocurrency. Minimal fees and transparent processing made the experience hassle-free.

Pros

Cons

Pricing:

Here are the FTMO Challenge pricing options:

| Initial Capital | Refundable Fee | Profit Target |

|---|---|---|

| $10,000 | €89 | $1000 |

| $25,000 | €250 | $2500 |

| $50,000 | €345 | $5000 |

Profit-sharing 80%-90%

5) PropW

PropW really grabbed my attention with its low initial capital requirement and free demo accounts—a great launchpad for beginner ETH/USDT and DeFi trading. I felt empowered to learn without risking my own capital, and I did manage to withdraw some early profits seamlessly. Their profit share is decent, though not market-leading, and I found the limited chart tools meant juggling TradingView on the side.

I also noticed support was patchy—sometimes lightning-fast, other times glacial. PropW’s Twitter recently touted up to 80 % profit share and funding up to 200,000 USDT, reinforcing its appeal if you can clear the challenge—and offering real upside when you perform.

SWOT Analysis

Features:

- User-Friendly Interface: The clean, intuitive design made trading a breeze. I could easily navigate through different sections, place orders, and monitor my positions without any confusion. This streamlined interface helped me focus on trading rather than figuring out the platform.

- Low Initial Capital Requirement: I appreciated how PropW allowed me to start with a small amount. This low barrier to entry gave me a chance to prove my skills without risking a large sum. It was perfect for me as a beginner in prop trading.

- Demo Account Availability: The demo account was a game-changer. I practiced my strategies risk-free before diving into live trading. This feature boosted my confidence and helped me understand the platform’s nuances without the stress of losing real money.

- Diverse Cryptocurrency Pairs: PropW offers a good range of crypto pairs. I mainly traded ETH/USDT, but I also dabbled in some DeFi tokens. The variety allowed me to diversify my strategies and explore different market segments.

- Prompt Profit Withdrawals: When I made profits, withdrawing them was hassle-free. The process was quick and straightforward, which I found motivating. Knowing I could access my earnings easily kept me engaged with the platform.

Pros

Cons

Pricing:

Here are the pricing plans for PropW Challenge Standard Mode:

| Starter | Intermediate | Advanced |

|---|---|---|

| $5,000 | $10,000 | $25,000 |

Profit-sharing Up to 90%

Benefits and Risks of Crypto Prop Trading

Before you take your step forward into the world of Crypto Prop Trading, let me explain the benefits and risks associated with such a trading option:

Benefits of Crypto Prop Trading

- Increased Profit Potential: Traders access larger capital bases, enabling bigger trades and higher returns. Example: John, a skilled trader, partners with a prop firm and earns an 80% profit share on a $100,000 trade, netting $8,000.

- Risk Management: Firms provide guidance and tools to mitigate losses. Example: Emily’s prop firm requires her to set stop-loss orders, limiting her losses to 10%.

- Access to Advanced Tools: Traders utilize institutional-grade platforms and software. Example: Michael’s firm provides proprietary trading software, allowing him to execute trades 30% faster.

- Flexibility and Autonomy: Traders work remotely, setting their schedules. Example: Sarah trades from home, managing her own time and workload.

Risks of Crypto Prop Trading

- Market Volatility: Cryptocurrency prices fluctuate rapidly, leading to potential losses. Example: David’s trade loses 20% value overnight due to an unexpected market downturn.

- Firm-specific Risks: Traders rely on firm stability and solvency. Example: James’s firm experiences financial difficulties, limiting his access to funds.

- Performance Pressure: Traders face pressure to perform, potentially leading to impulsive decisions. Example: Rachel feels pressured to meet profit targets, leading to over-trading and losses.

- Regulatory Uncertainty: Crypto regulations evolve rapidly, impacting trading environments. Example: Changes in tax laws affect Tom’s trading strategy, requiring adjustments.

Note: To mitigate risks, traders should:

- Research reputable firms

- Understand trading conditions and fees

- Set realistic goals and risk management strategies

- Stay informed about the latest market trends and regulatory changes

By acknowledging both benefits and risks, traders can navigate crypto prop trading effectively.

Requirements to Join a Crypto Prop Trading Firm

To join a crypto prop trading firm, traders typically need to meet specific requirements:

Initial Requirements

- Trading Experience: Proven trading experience, often 6-12 months, demonstrating consistency and profitability.

- Trading Knowledge: Understanding of technical analysis, risk management, and market dynamics.

- Age and Location: Typically 18+ years old, with no geographical restrictions (dependent on the firm).

Evaluation Process

- Application Form: Submitting personal and trading-related information.

- Trading Challenge: Completing a simulated trading challenge to assess skills.

- Psychological Evaluation: Assessing risk tolerance, emotional control, and decision-making.

- Interview: Discussing trading strategy, risk management, and expectations.

Financial Requirements

- Initial Deposit: Funding the trading account with the firm’s minimum requirement.

- Funding Options: Wire transfer, credit/debit card, or cryptocurrency deposits.

Ongoing Requirements

- Performance Metrics: Meeting profit targets, drawdown limits, and risk management standards.

- Trading Activity: Maintaining consistent trading activity.

- Continuing Education: Participating in firm-provided training and market analysis.

Documentation

- ID Verification: Providing government-issued ID and proof of address.

- Tax Documentation: Completing tax forms (e.g., W-8, W-9).

Firm-Specific Requirements

- Trading Platform Familiarity: Proficiency with firm-specific trading software.

- Compliance: Adhering to firm policies, regulatory requirements, and market regulations.

Meeting these requirements demonstrates a trader’s commitment, expertise, and potential for success within a crypto prop trading firm.

Note: Requirements may vary across firms. Research specific firms’ requirements before applying.

Tips and Tricks for Crypto Prop Trading

If you are planning to step into the world of Crypto Prop Trading, there are certain areas to focus on. I have accumulated a list of tips and tricks, nicely segregated under different sections, along with examples, for a better understanding:

Pre-Launch

- Educate yourself: Understand crypto markets, trading strategies, and risk management. Example: Study resources like Coindesk, TradingView, and CryptoSlate.

- Choose a reputable prop firm: Research firms like FTMO, Apex Trader Funding, or Take Profit Trader. Example: Compare fees, profit splits, and account sizes among firms.

- Set clear goals: Define profit targets, risk tolerance, and trading style. Example: Aim for 10% monthly returns, 2% maximum daily loss, and a scalping strategy.

Getting Started

- Start small: Begin with a smaller funded account ($5,000-$10,000). Example: FTMO’s $10,000 account requires a $155 evaluation fee.

- Familiarize yourself with platforms: Understand MetaTrader, TradingView, or proprietary software. Example: Practice trading on MetaTrader 4 with a demo account.

- Develop a trading plan: Outline strategies, risk management, and market analysis. Example: Create a plan document outlining (Blueprint)

Trading Strategies

- Trend following: Identify and ride market trends. Example: Buy Bitcoin when the price breaks above the 50-day moving average.

- Range trading: Profit from price fluctuations within established ranges. Example: Buy Ethereum for between $200 and $300 and sell at the opposite end.

- Scalping: Make multiple small profits from short-term trades. Example: Buy/sell Bitcoin every 15 minutes, targeting 1% profit.

- Hedging: Mitigate risk by opening opposing positions. Example: Buy Bitcoin and sell Ethereum to offset potential losses.

Risk Management

- Set stop-losses: Limit potential losses. Example: Set a 5% stop-loss for Bitcoin trades.

- Use position sizing: Manage risk by adjusting trade sizes. Example: Allocate 2% of the account to each trade.

- Diversify: Spread risk across multiple assets. Example: Trade Bitcoin, Ethereum, Litecoin, and Ripple.

- Monitor leverage: Adjust leverage according to market conditions. Example: Use 2x leverage during low-volatility periods.

Mindset and Discipline

- Stay focused: Avoid emotional decisions. Example: Take breaks, meditate, or exercise during trading sessions.

- Manage stress: Take breaks and maintain a work-life balance. Example: Trade 4 hours/day, spend time with family/friends.

- Continuously learn: Stay updated on market trends and strategies. Example: Attend webinars, read trading books, and join online forums. Subscribe to CryptoSlate Coindesk newsletters.

- Stick to your plan: Avoid impulsive decisions. Example: Set reminders to review the trading plan weekly.

Performance Optimization

- Analyze performance: Regularly review trading metrics. Example: Track profit/loss, win/loss ratio, and drawdown.

- Adjust strategies: Refine approaches based on performance data. Example: Adjust stop-loss levels or position sizing.

- Stay adaptable: Respond to changing market conditions. Example: Switch from trend following to range trading during sideways markets.

- Leverage technology: Utilize trading bots, indicators, and tools. Example: Use TradingView’s PineScript for custom indicators.

Additional Tips

- Join communities: Connect with fellow traders for insights and support. Example: Join Reddit’s r/CryptoTrading community.

- Set realistic expectations: Understand crypto prop trading’s risks and rewards. Example: Aim for 5-10% monthly returns.

- Continuously evaluate: Assess and improve trading skills. Example: Schedule quarterly performance reviews.

Which Mistakes Should Beginners Avoid with Crypto Prop Trading?

If you are a beginner in crypto prop trading, you may commit certain mistakes. Avoiding these mistakes can significantly improve your crypto prop trading performance.

- Over-leveraging (excessive borrowing)- Example: Using 10x leverage on volatile assets.

- Poor risk management– Example: Not setting stop-losses or position sizing.

- Emotional trading (impulsive decisions)- Example: Buying/selling based on fear or greed.

- Lack of diversification– Example: Trading only Bitcoin, ignoring other assets.

- Insufficient education– Example: Trading without understanding market analysis.

- Inadequate market analysis– Example: Ignoring trends, indicators, and news.

- Overtrading– Example: Executing multiple trades in short periods.

- Not adapting to market changes– Example: Failing to adjust strategies during market shifts.

- Ignoring position sizing– Example: Allocating excessive capital to single trades.

- Not keeping records– Example: Failing to track performance metrics.

Crypto Prop Trading Strategies for Volatile Markets

You can maximize profits and minimize losses in volatile (unpredictable) cryptocurrency markets with effective prop trading strategies:

| Strategy | Description | Example | Profit % |

|---|---|---|---|

| Range Trading | Buy near lower end, sell near upper end of established range | Buy 1 BTC at $42, Sell 1 BTC at $48 | 14.3% |

| Trend Following | Ride market waves using momentum and technical analysis | Buy 1 ETH at $62, Sell 1 ETH at $72 | 16.1% |

| Mean Reversion | Exploit price deviations, betting on returns to historical means | Buy 1 LTC at $120, Sell 1 LTC at $150 | 25% |

| Scalping | Execute rapid trades to profit from small price movements | Buy 0.1 BTC at $49.50, Sell 0.1 BTC at $50.50 | 2% |

| Market Making | Provide liquidity, earning spreads and fees | Buy 1 ETH at $200, Sell 1 ETH at $201 | 0.5% |

| Options Trading | Hedge risks and unlock new profit opportunities | Buy 1 call option (BTC $50 strike), Sell 1 call option (BTC $60 strike) | 20% |

| Arbitrage | Exploit price disparities across exchanges | Buy 1 BTC on Binance ($49), Sell 1 BTC on Coinbase ($51) | 4% |

| Quantitative Trading | Utilize algorithms and machine learning | Algorithm buys 1 ETH, sells 1 ETH at $72 | 16.1% |

Here are the advanced techniques in a separate table:

| Advanced Technique | Description | Example | Profit % |

|---|---|---|---|

| Options Trading | Hedge risks and unlock new profit opportunities | Buy 1 call option (BTC $50 strike), Sell 1 call option (BTC $60 strike) | 20% |

| Arbitrage | Exploit price disparities across exchanges | Buy 1 BTC on Binance ($49), Sell 1 BTC on Coinbase ($51) | 4% |

| Quantitative Trading | Utilize algorithms and machine learning | Algorithm buys 1 ETH, sells 1 ETH at $72 | 16.1% |

Optimize your crypto prop trading performance in volatile markets with these proven strategies.

Uncovering Fake Crypto Prop Firms and Their Tactics

The crypto prop trading landscape is vulnerable to scams and fraudulent activities. Fake firms lure unsuspecting traders with promises of unusually high returns, deceiving them out of their hard-earned money. Identifying red flags and tactics is crucial to avoiding financial losses.

| Tactic | Description | Example | Warning Signs | Consequences |

|---|---|---|---|---|

| False Profit Promises | Guaranteeing unusually high returns | “Earn 50% monthly returns with our expert traders!” | Unrealistic promises, lack of transparency | Financial loss, scam |

| Fake Performance Records | Displaying fabricated trading results | Falsified trading statements showing 100% annual returns | Unverifiable claims, inconsistencies | Financial loss, damaged reputation |

| Unregistered Operations | Lacking regulatory licenses and registrations | Failing to register with the SEC or FCA | Lack of regulatory oversight, unaccountability | Financial loss, legal issues |

| Hidden Fees | Charging excessive, undisclosed fees | Charging 20% hidden fees on withdrawals | Unclear fee structures, unexpected charges | Financial loss, frustration |

| Pressure Sales | Urging traders to deposit funds quickly | “Limited spots available! Deposit now to secure your spot!” | Urgency, scarcity tactics | Financial loss, impulsive decisions |

Examples of Fake Firms (ScamAdviser Trust Score)

- “CryptoProsper”: Promised 50% monthly returns, disappeared with $1M in deposits. (Trust Score: 41/100, https://www.scamadviser.com/check-website/cryptoprosper.my.id)

- “TydmGroup”: Fraudulent Trading Platform Pig Butchering Scam. (Trust Score: 1/100, https://www.scamadviser.com/check-website/tradegenesis.org)

- “CryptoWealth”: Operated unregistered, charged 20% hidden fees. (Trust Score: 1/100, https://www.scamadviser.com/check-website/cryptowealth.ink)

Protect Yourself from Fake Crypto Prop Trading Firms

- Research thoroughly: Verify firm credentials performance records.

- Verify registrations: Check regulatory licenses.

- Check online reviews: Research multiple sources.

- Understand fees: Clear, transparent fee structures.

- Don’t rush deposits: Take time to evaluate the firm.

Report Suspicious Firms

- Regulatory bodies (e.g., SEC, FCA)

- Online forums (e.g., Reddit, Trustpilot)

- Social media platforms

Stay informed, vigilant, and cautious to avoid falling prey to fake crypto prop firms.

How do we Choose Crypto Prop Trading Firms?

Selecting a trustworthy crypto prop trading firm is crucial for successful trading. At Guru99, we focus on several key factors while choosing the best Crypto Prop Trading Firms. By carefully evaluating these factors and watching for red flags, we make an informed decision to pick the most reliable crypto prop trading firms.

Consider these key factors:

1. Regulatory Compliance

- Verify licenses from reputable regulatory bodies (e.g., SEC, FCA, ASIC)

- Ensure compliances with anti-money laundering (AML) and know-your-customer (KYC) policies

2. Reputation and Reviews

- Research online reviews (e.g., Trustpilot, Reddit)

- Evaluate ratings and feedback from multiple sources

3. Trading Conditions

- Competitive spreads and fees

- Leverage options and margin requirements

- Trading platform quality and accessibility

4. Funding and Withdrawal Options

- Convenient deposit and withdrawal methods (e.g., bank transfer, credit card, crypto)

- Fast and secure transaction processing

5. Risk Management

- Stop-loss and take-profit orders

- Position sizing and risk-reward ratios

- Regular portfolio rebalancing

6. Trading Education and Support

- Quality educational resources (e.g., webinars, tutorials)

- Responsive customer support (e.g., live chat, email)

- Access to market analysis and research

7. Company Transparency

- Clear fee structures and trading conditions

- Regular updates on company performance and news

- Transparent ownership and management

8. Security Measures

- Robust encryption and data protection

- Secure trading platforms and servers

- Regular security audits

9. Scalability and Reliability

- Robust infrastructure and servers

- Fast execution and low latency

- Reliable trading platform uptime

10. Bonus and Incentives

- Competitive bonuses and promotions

- Referral programs and loyalty rewards

- Trading contests and challenges

Red Flags to Watch Out For

- Unregistered operations

- Unrealistic promises

- Hidden fees

- Poor online reviews

- Unresponsive support

- Lack of transparency

- Unsecure trading platforms

How would you define the Legitimacy of Crypto Prop Trading Firms?

Verifying the legitimacy of crypto prop trading firms is crucial for secure and profitable trading. Look for regulatory licenses from reputable bodies like the SEC, FCA, or ASIC and ensure registration with financial authorities. A physical address and transparent fees are also essential.

Research online reviews and evaluate trading conditions. Be wary of red flags like unregistered operations, fake licenses, hidden fees, and poor reviews. Consequences of trading with illegitimate firms include financial loss, data breaches, and regulatory issues. Prioritize legitimacy to safeguard your investments.

What are the Emerging Trends in Crypto Prop Trading?

Proprietary trading (prop trading) in the cryptocurrency market is evolving rapidly, driven by technological advancements and market dynamics.

- Algorithmic Trading: One significant trend is the use of algorithmic trading strategies. Firms are leveraging AI and machine learning to analyze vast datasets for predictive analytics, optimizing trade execution and minimizing risks. For example, firms like Alameda Research utilize sophisticated algorithms to capitalize on arbitrage opportunities across exchanges.

- Decentralized Finance (DeFi): Another emerging trend is the integration of DeFi protocols. Prop trading firms are increasingly participating in yield farming and liquidity provision, enhancing their profit margins. A real-time example includes Wintermute, which actively engages in DeFi markets to maximize returns through automated strategies.

These trends indicate a shift towards more data-driven and decentralized approaches in crypto prop trading, reflecting the broader evolution of financial markets.

FAQs

Verdict:

After thorough research, I’m convinced that the top three crypto prop trading firms are FTMO, FundedNext, and BitFunded. These firms offer the perfect blend of support and flexibility for aspiring traders.

- Funded Trading Plus: Funded Trading Plus’s comprehensive evaluation system and competitive profit sharing sealed the deal.

- BitFunded: BitFunded’s lightning-fast execution and competitive funding options sealed the deal.

- FundedNext: This crypto prop trading firm stood out with its generous profit-sharing model and comprehensive training resources.