7 BEST Prop Trading Firms in 2026 (Top Legit Companies)

Just starting in prop trading? You’re walking into a minefield. One wrong firm and your account’s toast—obliterated by hidden rules designed to trap you. Payouts stall. Slippage blindsides you. Scaling plans? Rigged to fail. I’ve watched latency sabotage razor-sharp edges and resets wipe out weeks of flawless execution. Some firms rewrite the rules mid-challenge, erasing your progress like it never happened. Courses peddle garbage strategies that chase noise, not risk. And the wrong tools? They’ll bury you—laggy charts, corrupted data, mismatched feeds that distort reality. If you want a fighting chance, choose firms that are verified, transparent, and built to protect your edge. Only then does your strategy get room to breathe—and win.

I clocked 160 hours dissecting 36 prop firms across global markets. This guide cuts through the noise and reveals the top 8 firms that actually deliver. Backed by real trades, deep dives, and no fluff—just raw insights, pros/cons, and pricing that won’t blindside you. If you’re serious about getting funded and skipping rookie mistakes, dive into the full article now. Read more…

Top Proprietary Trading Firms: Best Companies!

|

|

|

|

|

| Name | Funded Trading Plus | SabioTrade | FundedNext | TakeProfitTrader |

| Best For | Flexible funding / day-one payouts | High Profit Percentage / Wide Range of Assets | Range of trading instruments | Forex & Futures traders |

| Initial Balance: | $5,000 up to $200,000 | $20,000 | $25,000 up to $200,000 | $25,000 |

| Tradable Assets: | Forex, Commodities, Indices, and Cryptocurrencies. | Forex, stocks, cryptocurrencies, and more | Forex, Indices, Commodities, and Cryptocurrencies. | FX, Metals, Indices, Stocks, and more |

| Profit Split: | Up to 100% | Up to 90% | Up to 95% | Up to 80% |

| Scaling Plan: | Yes | Yes | Yes | Yes |

| Link | Learn More | Learn More | Learn More | Learn More |

1) Funded Trading Plus

Best Flexible Funded Trading Platform

In my experience, Funded Trading Plus is one of the most trusted and trader-focused prop firms in the industry. Founded in 2021 in London, it has built a strong reputation for transparency and reliability, backed by over 2,500 5-star reviews. With account sizes scaling up to $5,000,000, profit splits of up to 100%, and programs ranging from single-phase evaluations to instant funding, it offers unmatched flexibility. Add in fast onboarding, day-one payouts, and excellent customer service, and Funded Trading Plus stands out as an ideal choice for traders seeking both freedom and security to build sustainable trading earnings.

- Location: London, United Kingdom

- What they do: Offers one-stage funding, instant funding, and a classic two-stage funded account.

- Initial Balance: $5,000 - $200,000

- Refundable Registration Fee: Yes

- Profit-sharing: Up to 100%

Features:

- Multiple Trading Programs: Whether you’re an experienced trader or seeking instant funding, Funded Trading Plus has a program tailored to your goals. Choose from 1-phase, 2-phase, instant funding, or static drawdown accounts – giving you the flexibility to trade in a way that best fits your style and risk tolerance.

- Fast Onboarding: I received my account credentials within hours, meaning you don’t waste days waiting around. You can seize market opportunities quickly and start working toward profits almost immediately.

- Payouts From Day 1: Unlike many competitors who require you to wait weeks or hit certain milestones, Funded Trading Plus allows you to withdraw from your very first trade. Thereafter withdrawals are weekly to give you fast access to your hard-earned simulated profits and greater control over your cash flow.

- Profit Split Up to 100%: I was amazed by their industry-leading profit sharing structure. Keeping 100% of your trading profits maximizes income potential significantly. This generous split ensures your trading skills are rewarded fairly and encourages long-term partnership growth.

- Scalable Account Growth: Start small and grow with confidence, accounts can scale up to $5,000,000 in simulated capital by doubling each time you achieve a 10% profit milestone. This gives ambitious traders the opportunity to build toward professional-level funding without the need for personal risk.

- Trusted Reputation: With over 2,500 five-star Trustpilot reviews, traders consistently highlight Funded Trading Plus for its transparency, reliability, and fast payouts. You can trade with peace of mind knowing you’re backed by one of the most trusted firms in the industry.

Pros

Cons

What you can Trade?

Forex, Commodities, Indices, and Cryptocurrencies (CFDs).

Profit Share:

80% initially, which can scale up to 100% through the VIP Program’s tiered structure (e.g., 90% in Bronze, 100% in Silver+).

Funding Amounts:

Offers funding packages starting from $5,000 and scaling to $200,000, accommodating traders of varying experience levels and risk preferences.

Use Coupan Code “GURU20” and Get 20% OFF on Experienced Trader Programs

Profit-sharing Up to 100%

2) SabioTrade

Best professional funding trader program firm

SabioTrade stands out for its comprehensive evaluation process, flexible trading rules, and competitive profit splits up to 90%. I liked how the platform offers multiple account sizes and provides traders with the freedom to trade various instruments including forex, indices, and commodities. Traders can choose from different evaluation programs, manage multiple funded accounts, and benefit from professional trading conditions with tight spreads and fast execution. It feels built for serious traders who want professional-grade infrastructure and transparent, reliable payout systems.

Their platform often features promotional campaigns and educational resources, helpful for newcomers testing their trading strategies before scaling up. The transparent fee structure and clear trading rules support confidence in the evaluation process. SabioTrade’s focus on trader development through educational content and mentorship programs offers practical guidance that beginners can follow for skill improvement and risk management. Combined, these features suggest a solid foundation for consistent traders seeking professional funding opportunities.

- Location: Dublin, Ireland

- What they do: You can trade Forex, Commodities, Indices, Crypto

- Initial Balance: $20,000

- Refundable Registration Fee: Yes

- Profit-sharing: Up to 90%

- Leverage: 30:1 for Forex, 20:1 for equities and indices, 3:1 for crypto

Features:

- Multiple Evaluation Programs: SabioTrade offers various evaluation challenges to suit different trading styles. You can choose the program that matches your risk tolerance and strategy. It provides flexibility in qualification requirements and timeframes. I prefer programs with reasonable profit targets and manageable drawdown limits.

- Diverse Trading Instruments: The platform supports trading in forex, indices, commodities, and cryptocurrencies. You can diversify your portfolio across multiple asset classes. It enables comprehensive market exposure and strategy diversification. I’ve found cross-market opportunities particularly valuable during volatile periods.

- Flexible Account Sizes: SabioTrade provides account sizes ranging from smaller starter accounts to larger professional accounts. You can scale according to your experience and capital requirements. It accommodates both new and experienced traders effectively. The progression system allows natural growth as skills develop.

- Professional Trading Conditions: The platform offers institutional-grade spreads, fast execution, and reliable infrastructure. You can execute strategies without worrying about technical limitations. It maintains consistent performance during high-volatility periods. The professional environment supports serious trading operations.

- Educational Resources: SabioTrade provides comprehensive educational materials and mentorship programs. You can continuously improve your trading skills and market knowledge. It includes webinars, tutorials, and market analysis. The learning resources help bridge knowledge gaps effectively.

- Transparent Profit Sharing: The platform offers clear profit-sharing arrangements up to 90% for funded traders. You can understand exactly how earnings are distributed. It provides predictable income potential for successful traders. The transparent structure builds trust and long-term relationships.

“Webinars and mentorship are the standout—sessions with Markus answered specific questions and a single tip helped close a $1,500 trade; the education layer feels unusually practical for a prop firm.” — Stefan Gutenberg, Funded Trader

Pros

Cons

What you can Trade?

Forex (CFDs), Indices, Commodities, and Stocks (250+ assets).

Profit Share:

Up to 90%

Funding Amounts:

Provides funding from $20,000 to $1,000,000 allowing traders to progressively scale accounts as they demonstrate consistent performance and discipline.

Profit-sharing Up to 90%

3) FundedNext

Best range of trading instruments

FundedNext offers one of the strongest mixes of capital and flexibility, with up to $300,000 buying power and a 95% profit split in funded accounts. I like that they even pay a 15% profit share during the challenge, which cushions early grind and keeps motivation high. Spreads are tight, leverage is high, and platform choice is broad—MT4, MT5, cTrader, and Match-Trader—so strategies port cleanly. There are no minimum trading days, and monthly free competitions add upside for disciplined traders and swing specialists alike.

Lately, their X posts have leaned into trader psychology and performance habits, echoing risk discipline that pairs well with FundedNext’s structured 1-step evaluation and fast payouts messaging. That’s useful for novices building consistency under realistic drawdown and target rules while scaling within a clear framework.

Features:

- Leverage for Forex Instruments: This feature offers leverage up to 1:30 on simulated Forex. It enables disciplined position sizing with defined risk. You can scale strategies without overexposure. I’ve used 1:30 to stress-test entries during news volatility.

- Guaranteed Payouts: It promises payouts within 24 hours, which reduces liquidity risk. If delayed, traders receive an extra $1,000. This policy strengthens counterparty trust. I have seen payouts land quickly, which stabilizes cash-flow planning.

- High-Profit Split: This feature provides up to a 95% profit split, maximizing retained edge. It preserves strategy alpha after costs. You can compound efficiently under favorable conditions. I’ve found higher splits encourage disciplined risk-to-reward alignment.

- Account Sizes: It supports balances up to $300,000 for scaling capacity. That sizing accommodates diversified systems. You can stage trades across instruments methodically. Larger notional lets risk per trade stay conservative while sizing the opportunity.

- No Minimum Trading Days: This feature removes minimum simulated trading days in challenges. It reduces forced trading behavior. You can wait for A+ setups. This flexibility aligns with probabilistic edge and event-driven strategies.

- Challenge-Phase Profit Share: It includes a 15% profit share during the challenge phase. That creates earlier incentive alignment. You can offset fees sooner. This structure rewards consistency while progressing to funded status.

Pros

Cons

What you can Trade?

Forex, Indices, Commodities (Metals/Energy), and Cryptocurrencies (CFDs).

Profit Share:

Starts at 80% or 90% (Varies by account model) and can scale up to 90% or 95% with performance/add-ons.

Funding Amounts:

Traders can hold multiple funded accounts with combined capital allocations of up to $300,000, enabling strategic diversification and growth.

Profit-sharing Up to 95%

4) TakeProfitTrader

Best for Forex & Futures traders

TakeProfitTrader makes funded futures trading feel straightforward and fast. Accounts start at $25,000, with profit-sharing up to 80%, and immediate withdrawals from day one of the PRO account are a standout. I liked how the evaluation is simple, making it approachable for first-timers. The platform’s intuitive flow and supportive structure help novices build confidence without risking personal capital. Pricing is clear: $150 for $25,000, $170 for $50,000, and $245 for $75,000 accounts. Recently on X, they’ve been promoting daily PRO withdrawals and limited-time discount codes, underscoring quick payouts and accessibility.

TakeProfitTrader is best for Forex and Futures traders seeking a clean path to funding with practical rules and quick payouts. I found the “trade and withdraw from day one” experience refreshingly no-nonsense. New traders value the low-risk model and reliable profit access, while the fee structure stays predictable across starter tiers. Their X updates often highlight “get paid daily in PRO” and flash sales like NOFEE40, which align with frequent-withdrawal use cases for active day traders seeking consistency and momentum. Profit-sharing remains up to 80%, keeping incentives aligned for steady growth.

- Location: Florida

- What they do: Provide prospective day traders with a simulated account.

- Initial Balance: $25k

- Refundable Registration Fee: No

- Profit-sharing: Up to 80%

Features:

- High-Profit Split: I could benefit from a high-profit split of up to 95%, which allowed me to maximize my earnings effectively. This solution is great for traders looking to increase their overall returns. I have noticed that this structure helps you grow your capital without worrying about excessive fees. While utilizing the high-profit split, I noticed a remarkable boost in my returns. As a seasoned prop trader, I assisted a firm achieve profits, affirming this feature’s effectiveness and impact.

- Guaranteed Payouts: FundedNext ensures payouts within 24 hours. If delayed, traders receive an additional $1,000, which makes it a secure and reliable choice. This helps traders trust the system, knowing that their funds are protected. I have tested this, and the process runs smoothly every time.

- Leverage for Forex Instruments: I could trade simulated Forex instruments with up to 1:30 leverage, which provided significant returns. It’s important to consider this leverage option as it allows you to optimize your strategy. I have seen that it is one of the most effective ways to scale a trading account.

- No Minimum Trading Days: FundedNext ensures that there are no minimum simulated trading days required for either challenge phase, which provides flexibility. This feature helps you execute trades at your own pace without compromise. One of the best things about this is that you avoid the pressure of forced trades.

- Multiple Platforms: Traders can choose from MT4, MT5, cTrader, and Match-Trader platforms, ensuring flexibility and convenience. This is great for traders who prefer a versatile trading experience. I noticed that having multiple platform options ensures your trading style remains consistent across different interfaces.

- Account Sizes: Traders can access trading accounts with balances up to $300,000, providing substantial capital for trading. It is best for those looking to scale their portfolio effectively. Besides, this feature helps you take on larger trades while maintaining risk control.

Pros

Cons

What you can Trade?

Futures across Equity Index, Interest Rate, Currency, Commodity, and Crypto.

Profit Share:

Offers an 80/20 split, which can be upgraded to 90/10 with their PRO+ account option.

Funding Amount:

Gives traders access to funded accounts ranging between $25,000 and $150,000, with clear profit targets and risk parameters.

Profit-sharing Up to 80%

5) FTMO

The most secure platform

FTMO stands out for a disciplined, two-step evaluation with a refundable fee and profit splits up to 90% after funding. Accounts start from $25,000 for $250, with 1:100 leverage and a $1,000 profit target noted in the listing. I like how its analytics and DXtrade web interface sharpen execution and post-trade review. The Premium Programme can open doors to Quantlane roles, adding career upside for consistent performers. On X, FTMO regularly stresses sticking to plans and risk control—timely reminders that align with its max 5% daily drawdown guidance and structured rules.

Their public messaging also highlights “monetize your demo trading” and the $200,000 account path, reflecting its simulated model with rewards up to 90% of simulated profits—useful for novices to build habits without personal capital at risk. I’ve found the cadence of trader tips on X practical when syncing with evaluation milestones and daily loss limits. If starting from $50,000 for $345, anchor around rule discipline, then leverage the platform tools to iterate faster while aiming for verification consistency and eventual scale to $2M.

- Location: Czech Republic

- What they do: FTMO prop trading firm offers a variety of trading instruments, including forex.

- Initial Balance: 25k balance for $250, 50k balance for $345

- Refundable Registration Fee: Yes

- Profit-sharing: Up to 90%

- Leverage: 1:100

- Profit Target: $1,000

Features:

- Premium Programme: FTMO offers career upside beyond payouts with FTMO’s Premium Programme. It connects top performers to Quantlane for potential salaried roles. That bridge matters for longevity and stability. It formalizes a path from funding to professional trading.

- Advanced Trading Analytics: This feature delivers granular performance analytics to isolate strengths and weaknesses. It helps quantify edge, not just track P&L trends. You can analyze expectancy, win distributions, and drawdowns precisely. I’ve used such tools to refine entries and risk

- Refundable Challenge Fee: FTMO refunds the fee after passing and the first profit withdrawal. It reduces evaluation friction and perceived downside materially. That policy boosts psychological commitment during the challenge. It aligns incentives toward disciplined, rule-consistent execution.

- DXtrade Web Interface: It provides an ultra-responsive web platform integrated with FTMO flows. It improves order routing, charting, and speed-sensitive workflows significantly. I’ve experienced smoother execution and quicker order amendments here. It’s helpful during fast macro catalysts and spikes.

- Profit Split Up To 90%: This platform scales the reward share up to 90% based on performance. Higher tiers motivate continued risk discipline and longevity. It’s meaningful for compounding funded capital efficiently over time. I’ve seen behavior improve as incentives stepped up.

Pros

Cons

What you can Trade?

Forex, Indices, Commodities, Stocks, and Cryptocurrencies (CFDs).

Profit Share:

Offers an 80% profit split, which can scale up to 90% for consistent, high-performing traders.

Funding Amount:

Provides funding opportunities from $10,000 to $200,000, with the potential for account scaling based on consistent profitable performance.

Profit-sharing Up to 90%

6) FXIFY

Best for full-size account trading

FXIFY is positioned for novices who want bigger, faster capital access with structure and support. I liked how its evaluation paths include a 1‑Step option and instant funding flexibility for quick starts, while keeping up to 90% profit share and clear rules intact. Backed by broker FXPIG, spreads are competitive, platforms include MT4/MT5/DXtrade, and funded accounts go up to $400,000. On X, FXIFY highlights commission‑free trading options and tight spreads on FX, metals, and indices, which suit swing strategies, building consistency early.

FXIFY also leans into fast, on‑demand payouts and scaling paths, with programs tailored for speed, affordability, or conventional evaluations. I found the All‑in, evaluation, and instant models practical for mapping risk goals to payout cadence and discipline. Recent posts emphasize transparent rules and early payouts after a profitable trade, reinforcing confidence for first challenges and step‑ups. Pair the commission‑free access and flexible evaluations with strict risk logs to pass and scale methodically.

- Location: London, England

- What they do: Offers 1-Step Evaluation with clear and attainable targets

- Initial Balance: $25,000

- Refundable Registration Fee: No

- Profit-sharing: 90%

Features:

- Centralized Dashboard: This feature puts account metrics, payouts, and evaluation status together. It helps monitor drawdown, profit, and milestones without switching screens. I found decision-making faster with all data centralized. It saves time during volatile sessions.

- Risk Management Tools: It provides guardrails to manage daily and overall risk effectively. Preset parameters help prevent accidental breaches during news spikes. You can calibrate position sizing faster. It protects consistency across multi-asset strategies.

- Trade Execution Speed: FXIFY delivers fast routing that reduces slippage on liquid pairs. I’ve seen tighter fills on indices during volatility. It keeps entries near intended levels. Exits feel more controlled under pressure.

- Drawdown Framework: It applies daily and overall drawdown controls. Typical bands span 3%–5% daily and 5%–10% total. You can plan sizing within these guardrails. It standardizes risk discipline across phases.

- Profit Withdrawal System: FXIFY follows a structured schedule and conditions for payouts. This predictability helps plan cash flows and compounding. You can align withdrawals with strategy cycles. It reduces uncertainty around realized gains.

- Funding Tiers: It scales buying power as performance milestones are achieved. Growing allocation rewards discipline and repeatability. You can expand risk within rules. It keeps progression merit-based and transparent.

Pros

Cons

What you can Trade?

Forex, Indices, Precious Metals, Energy Commodities, and Cryptocurrencies (CFDs).

Profit Share:

Profit splits begin at 80%, with the potential to reach 90% through specific add-ons or plans.

Funding Amount:

Enables traders to manage up to $450,000 in capital, supporting ambitious traders through competitive profit splits and growth-friendly rules.

Profit-sharing Up to 90%

7) FTUK

Best for no minimum trading day rules

FTUK stands out as a global prop firm offering flexible paths to capital—one-step, two-step, and instant funding—allowing you to scale accounts quickly, up to $6.4M, with a max 80% profit split for consistent traders. Their 14-day free trial lets you test the waters before committing, and I like how they reward strong performance with aggressive scaling and fast payouts—often within an hour. Just last month, I saw their community buzzing about lightning-fast withdrawals and transparency in rules—vital when you’re new to prop trading and want a clear, trustworthy partner, not just another gatekeeper.

Staying updated with FTUK’s X handle (@Ftuk_com) gives me extra confidence—I often spot live updates on new trader incentives, educational content, and platform upgrades. For example, their recent posts highlight partnerships with leading trading tools and analytics dashboards, which can really help beginners get a clearer edge. You don’t need to go in blind; FTUK encourages traders to engage, ask questions, and share strategies, building a community vibe. That’s rare for prop firms and makes it easier to see real users’ experiences and problems, not just polished marketing—so you know what you’re signing up for.

- Location: London, UK.

- What they do: Forex + Indices + Commodities + Metals

- Initial Balance: $14,000

- Refundable Registration Fee: No

- Profit-sharing: Up to 80%

- Leverage: 1:100

Features:

- Remote Trading: This feature lets FTUK accounts run from anywhere globally. It supports flexible execution across sessions and locales. Latency felt tight during active hours in my tests. Orders executed cleanly under volatile prints.

- Instant Funding: It provides immediate access to live funds upon joining. Traders can start from day one with firm capital. Onboarding is straightforward, avoiding long qualification queues. It meaningfully reduces time-to-first-payout risk.

- Augmented Growth Program: You can double funding after each milestone achieved. It supports rapid, structured scaling for consistent performers. Capital expands in step with verified profitability progression. The plan helps maintain disciplined growth habits.

- Leverage and Risk Management: It offers leverage up to 1:100 for trading power. Absolute drawdown and fixed equity stop-out are enforced. These constraints harden discipline during adverse moves. Position sizing matters more with higher gearing.

- Scaling Plan: FTUK doubles capital after a 10% profit target is hit. Progressively scales accounts while limiting risk exposure. Structured steps reduce overreach during growth spurts. It is one of the most effective expansion frameworks.

Pros

Cons

What you can Trade?

Primarily Forex, but also allows trading other available CFDs on the platform.

Profit Share:

FTUK’s profit share ranges from up to 80% for Forex accounts to 100% (up to $15,000) for Futures accounts.

Funding Amounts:

Offers starting accounts from $5,000, with scaling options that can ultimately reach an impressive $6.4 million in available funding.

Profit-sharing Up to 80%

Comparison between the best Prop Trading Firms

| Prop Firm | Funded Trading Plus | SabioTrade | FundedNext | TakeProfitTrader |

|---|---|---|---|---|

| Joining Fee | $50 | $50 (for $10K account) | $109 | $360 |

| Profit Split | Up to 100% | Up to 90% | Up to 90% | Up to 80% |

| Profit Target | 10% | 10% | 8% | $3,000–$9,000 for $50K–$150K accounts |

| Maximum Funding Leverage | 30:1 | 30:1 (Forex) | 1:100 | Not applicable |

| Tradeable Assets | Forex, Commodities, Indices, and Cryptocurrencies (CFDs) | 250+ assets (Forex, Stocks, Commodities, Crypto, Indices, ETFs) | Forex, Indices, Commodities, Crypto, Metals | FX, Metals, Indices, Stocks, and more |

What is prop trading?

Proprietary trading, or prop trading, is when traders use a firm’s capital—not their own—to trade financial instruments like forex, stocks, or futures. The goal is to generate profit for the firm, and successful traders usually earn a cut of those profits. It’s appealing because it offers access to big capital and resources, but traders must consistently prove skill and discipline to keep their funded accounts active.

What is a proprietary trading firm?

A proprietary trading firm (or prop firm) is a company that funds skilled traders with its own money. Instead of earning commissions or client fees, the firm profits directly from traders’ winning trades. In return, traders receive a percentage of those profits. These firms often provide evaluations or “challenges” to assess trading ability before granting access to larger accounts—essentially turning trading talent into a funded partnership.

What makes a prop trading firm good?

A great prop firm combines fair profit splits, realistic rules, and responsive support. Transparency about trading conditions, payout reliability, and account scaling potential separates the legit firms from the shady ones. Strong educational resources and flexible trading platforms are also key. In short, a good prop firm helps traders grow, not trap them with hidden rules or impossible risk limits—trust and fairness define real value here.

What are the most popular prop trading firms?

Some of the most recognized prop trading firms today include APEX Trader Funding, SabioTrade, FundedNext Trader, and Funded Trading Plus. Each offers slightly different evaluation models, payout structures, and asset focuses. Popularity often depends on transparency, payout reliability, and trader community trust—factors that matter more than flashy marketing or high leverage.

What is a challenge?

A “challenge” in prop trading is a test designed by the firm to evaluate a trader’s skill and discipline before granting a funded account. Traders must meet specific profit targets while following strict drawdown and risk management rules. Completing a challenge proves a trader can perform consistently under pressure—essentially earning the firm’s confidence. Fail the rules, and you’re out; pass them, and you trade real money.

Who should try prop trading?

Prop trading suits disciplined traders with proven strategies but limited personal capital. It’s ideal for those comfortable with risk management, consistent execution, and emotional control. However, it’s not for beginners or gamblers—it demands patience, focus, and adaptability. If you’ve developed a track record and want to scale your strategy without risking personal savings, prop trading offers a realistic path to professional-level opportunity.

What challenges do traders commonly face during prop firm evaluations?

Traders often struggle with strict drawdown limits, overtrading, and the psychological pressure of trading someone else’s capital. Many fail due to impatience—chasing profit targets too quickly instead of letting setups develop. Inconsistency, emotional trading, and ignoring rules can sabotage success. The best approach is to treat the evaluation like real trading: risk small, stay calm, and follow a plan. Prop firm success rewards consistency, not aggression.

What trading platforms are used for prop trading?

Most prop firms rely on established platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader due to their reliability and compatibility with automation tools. Futures-focused firms may use NinjaTrader or Tradovate. The right platform depends on the firm and trader preference—execution speed, charting tools, and order flexibility all matter. Ultimately, a good prop firm gives traders a choice rather than forcing a single platform.

How to avoid red flags and prop firm scams?

You must avoid firms promising guaranteed profits or instant riches. It is necessary to check company details and team transparency. Verify broker partners and legal entities. I suggest that you should read the terms for hidden limits or traps. Look for unfair slippage or payout delays. Confirm support responsiveness and documentation quality. Research third-party reviews across platforms. Beware frequent rule changes without notice. Prefer firms with stable, long histories. When unsure, start small and observe.

How Did We Choose the Best Prop Trading Firms?

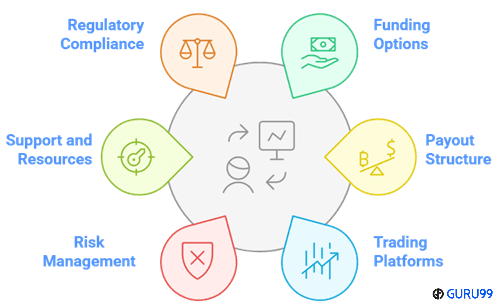

At Guru99, we prioritize credibility by ensuring our content is accurate, relevant, and objective. Our team conducted an in-depth evaluation of 36+ proprietary trading firms, investing over 298 hours to identify the best options. This guide offers a transparent breakdown of features, pricing, and key considerations, helping traders make informed decisions. We assessed firms based on risk management, capital allocation, transparency, and trader support. Finding the right firm requires expertise and industry knowledge, and we focus on the following factors while reviewing a tool based on.

- Funding Options: We made sure to shortlist firms that provide diverse capital allocation based on trader experience.

- Payout Structure: Our team chose firms with fair profit-sharing models that maximize earnings while maintaining sustainability.

- Trading Platforms: The experts in our team selected firms offering ultra-responsive platforms optimized for efficiency and reliability.

- Risk Management: We ensured that firms have transparent risk policies that help traders manage capital with ease.

- Support and Resources: Our team considered firms that provide continuous education, mentorship, and robust customer support.

- Regulatory Compliance: We chose based on firms’ adherence to financial regulations to ensure security and trustworthiness.

How does one get started with a Prop Trading Firm?

Here are the steps that you can follow to get started with a prop trading firm:

Step 1) Understand the basics of Prop trading: Learn how prop trading works, processes, etc., for a better understanding.

Step 2) Get Trading and Market knowledge: You should study and analyze how trading and markets work.

Step 3) Go through the market rules: You need to understand and follow all the market rules associated with trading.

Step 4) Make a trading strategy: Study and prepare a trading strategy for executing your trades.

Step 5) Practice with risk management: Analyze and practice risk management using historical data.

Step 6) Try paper trading: Before starting actual trading, you should practice paper trading on simulator accounts provided by trading firms.

Step 7) Do research to select the best proprietary trading firm: You can go through the list given above to study all the proprietary trading firms and how they operate.

Step 8) Apply to a Proprietary firm as a Trader: Once you are ready for trading, you can apply to a proprietary trading firm to start trading.

Step 9) Get evaluated: Once you apply to a proprietary trading firm, you need to be evaluated by the firm in different ways to qualify.

Step 10) Get funded: Once you are evaluated, you can now get capital funding to trade with your strategy.

What prop firm rules most affect profitability and risk?

Daily drawdown rules drive intraday risk management discipline. Max loss rules determine survival during volatility spikes. Profit targets and time limits shape strategy selection constraints. News and weekend restrictions affect swing trading plans. Scaling rules impact compounding and capital efficiency. Payout schedules affect liquidity and psychology. Platform quality influences slippage and execution reliability. Reset policies change expected evaluation costs significantly. Hedging and copy limits sometimes restrict advanced strategies. Match rules with the strategy and temperament carefully.

Verdict

Selecting a proprietary trading firm requires careful evaluation of funding options, profit-sharing models, and trading conditions. I have reviewed several firms that offer unique benefits to traders looking to maximize their potential. Check my verdict to find the most reliable options.

- Funded Trading Plus: It is perfect for traders seeking a reliable and flexible partner.With instant funding options, no time-limit evaluations, and payouts starting immediately, it stands out as one of the most trader-friendly prop firms in the market.

- SabioTrade: It offers a structured one-step evaluation process and no minimum withdrawal limits, making it an excellent choice for traders looking for a streamlined funding model with up to 90% profit sharing.

- FundedNext: It offers one of the strongest mixes of capital and flexibility, with up to $300,000 buying power and a 95% profit split in funded accounts.