6 Best Forex Trading Prop Firms (2026)

Forex prop trading firm funds your account, lets you execute your trading strategies, and allows you to split the profit. Forex is the world’s second-largest marketplace after the stock market. A good trader can make quick and sizeable profits by trading on short-term currency trends. It is important to find a reliable platform for Forex trading to receive good profit, real-time prices, instant trading, security and more.

After 100+ hours of research on 40+ best Forex trading prop firms, I have created an insightful, in-depth guide. My trusted and well-researched article details the features, pros and cons, and pricing of each firm to help you make an informed decision. Do not miss out on this must-see guide—read the full article for exclusive, verified insights. Read more…

Best Forex Prop Trading Firms: Top Picks!

|

|

|

||

| Name | Funded Trading Plus | FundedNext | TakeProfitTrader | FTMO |

| Initial Balance: | $5,000 – $200,000 | $6000 | $25,000 | $10,000 |

| Forex Pair Supported: | EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, USD/JPY, etc. | EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD | EUR/USD, GBP/USD, GBP/JPY, USD/CAD, and AUD/USD. | EUR/USD, GBP/USD, GBP/JPY, USD/CAD, and AUD/USD. |

| Profit Split: | Up to 100% | Up to 95% | Up to 80% | Up to 90% |

| Link | Learn More | Learn More | Learn More | Learn More |

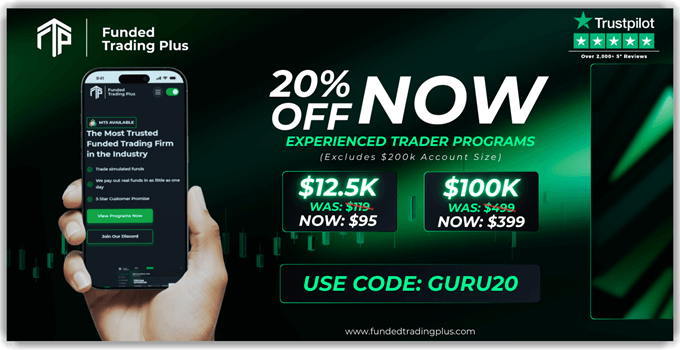

1) Funded Trading Plus

Best Flexible Funded Trading Platform

In my experience, Funded Trading Plus is one of the most trusted and trader-focused prop firms in the industry. Founded in 2021 in London, it has built a strong reputation for transparency and reliability, backed by over 2,500 5-star reviews. With account sizes scaling up to $5,000,000, profit splits of up to 100%, and programs ranging from single-phase evaluations to instant funding, it offers unmatched flexibility. Add in fast onboarding, day-one payouts, and excellent customer service, and Funded Trading Plus stands out as an ideal choice for traders seeking both freedom and security to build sustainable trading earnings.

Features:

- Multiple Trading Programs: Whether you’re an experienced trader or seeking instant funding, Funded Trading Plus has a program tailored to your goals. Choose from 1-phase, 2-phase, instant funding, or static drawdown accounts – giving you the flexibility to trade in a way that best fits your style and risk tolerance.

- Fast Onboarding: I received my account credentials within hours, meaning you don’t waste days waiting around. You can seize market opportunities quickly and start working toward profits almost immediately.

- Payouts From Day 1: Unlike many competitors who require you to wait weeks or hit certain milestones, Funded Trading Plus allows you to withdraw from your very first trade. Thereafter withdrawals are weekly to give you fast access to your hard-earned simulated profits and greater control over your cash flow.

- Profit Split Up to 100%: I was amazed by their industry-leading profit sharing structure. Keeping 100% of your trading profits maximizes income potential significantly. This generous split ensures your trading skills are rewarded fairly and encourages long-term partnership growth.

- Scalable Account Growth: Start small and grow with confidence, accounts can scale up to $5,000,000 in simulated capital by doubling each time you achieve a 10% profit milestone. This gives ambitious traders the opportunity to build toward professional-level funding without the need for personal risk.

- Trusted Reputation: With over 2,500 five-star Trustpilot reviews, traders consistently highlight Funded Trading Plus for its transparency, reliability, and fast payouts. You can trade with peace of mind knowing you’re backed by one of the most trusted firms in the industry.

Pros

Cons

Pricing:

Funded Trading Plus offers several program options to fit traders of all levels:

| Program | Initial Balance | Fees |

|---|---|---|

| Experienced Trader Program (1-Phase) | $12,500 – $200,000 | $499 |

| Premium & Advanced Trader Programs (2-Phase) | $25,000 – $200,000 | $549 |

| Master Trader Program (Instant Funding) | $5,000 – $100,000 | $1125 |

| Prestige Lite Program (2-Phase, Static Drawdown) | $25,000 – $100,000 | $389 |

Use Coupan Code “GURU20” and Get 20% OFF on Experienced Trader Programs

Profit-sharing Up to 100%

2) FundedNext

FundedNext impressed me with its thoughtful design and realistic approach to simulated trading. I evaluated its challenge phase and found that it focuses more on consistency than just big profits, which is what many top firms want. I suggest going through their rules carefully, as they are strict but fair.

In my experience, the transparency stood out. For example, the daily drawdown and profit targets are aligned with real-market expectations. Financial analysts are using it to validate new strategies before going live, thanks to its data-rich simulation tools.

Features:

- Profit Split: I could earn up to 95% profit split, which truly maximized my returns. This structure is ideal for traders aiming to scale their income without taking on added risk. While using this feature one thing I noticed was that consistency in trades helped unlock the higher split tiers faster.

- Leverage Options: I could trade with up to 1:30 leverage, which significantly amplified my simulated trading capacity. This setting is helpful for testing advanced strategies without excessive capital. The tool lets you control position sizing tightly, which is crucial when using higher leverage.

- Trading Instruments: I received access to commodities, forex pairs, indices, and even cryptocurrencies. This variety allowed me to diversify and test multiple market behaviors. I suggest focusing on a few instruments initially to better track performance patterns.

- Initial Balance: FundedNext provides accounts ranging from $25,000 to $200,000. I personally started with $100,000 and found it perfect for running several strategies at once. This balance range gives you flexibility based on your trading style.

- Evaluation Process: This prop firm offers a 1-step evaluation model, which I found refreshingly straightforward. Targets were realistic and clearly explained in the dashboard. I recommend reviewing the daily drawdown rules carefully—clarity here will help avoid disqualification.

- Payout Methods: I received my earnings via bank wire, crypto, and card payments—all processed without delays. Having multiple options gave me peace of mind. I once chose USDT for a faster payout during a high-volatility week, and it worked flawlessly.

Pros

Cons

Pricing:

Here are the best pricing offered by FundedNext:

| Buying Power | Profit Split | Fees |

|---|---|---|

| $5,000 | 95% | $32 |

| $10,000 | 95% | $59 |

| $25,000 | 95% | $139 |

| $50,000 | 95% | $229 |

| $100000 | 95% | $399 |

Profit-sharing Up to 95%

3) TakeProfitTrader

Best for high rewards and flexibility

In my professional view, TakeProfitTrader offers a streamlined onboarding process that caters to traders seeking quick results. Their model provides clear funding rules and immediate access to real accounts, eliminating the typical delays associated with funding challenges. TakeProfitTrader is ideal for those who want to trade without unnecessary delays. Its instant access feature effectively cuts through the noise of traditional funding challenges.

Features:

- Instant Account Activation: TakeProfitTrader provides immediate access to live accounts upon signup, allowing traders to start trading with capital from day one. This feature is perfect for traders confident in their strategies and looking to avoid delays.

- Comprehensive Risk Management: The platform offers robust risk management tools, ensuring traders can manage their strategies effectively without risking personal funds. This is particularly beneficial during volatile market conditions.

- Flexible Profit Sharing: Traders can enjoy a generous profit-sharing model, retaining a significant portion of their earnings. This structure incentivizes consistent performance and aligns with industry standards.

- Scalable Funding Options: TakeProfitTrader allows traders to scale their accounts based on performance, providing opportunities for growth and diversification across various trading strategies.

Pros

Cons

Pricing:

The pricing structure for the TakeProfitTrader platform is as follows:

| Buying Power | Fees |

|---|---|

| $25,000 | $150 |

| $50,000 | $170 |

| $75,000 | $245 |

Profit-sharing Up to 80%

4) FTMO

Best secure funded trading platform

In my experience, FTMO’s is a great option for anyone looking to grow in the forex trading space. As I carried out my evaluation, I noticed the firm’s reward system, allowing up to 90% of profits, is one of the best in the industry. I found that the lack of minimum trading days gives flexibility, which can be helpful to swing traders. The tool made it possible for me to simulate large-account trading and receive rewards without risking my own capital. My advice is to pay attention to their rules, and you can truly benefit.

Features:

- 2-Step Evaluation Process: I noticed that FTMO has developed a 2-step evaluation process that allows you to showcase your trading talents. You can receive an FTMO account with a balance of up to $200,000 if successful.

- Choice of Trading Platforms: FTMO offers its clients a selection of popular trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and the new DXtrade web platform. According to my research, these platforms provide traders with diverse options to suit their preferences and trading styles.

- Robust and Reliable Solutions: I found the platforms offered by FTMO robust and reliable, catering to the needs of most traders and ensuring a seamless trading experience.

- cTrader Platform: Despite being the newest platform with a modern look and feel, cTrader has garnered interest among FTMO clients, with a growing number of users showing interest in this platform.

- DXtrade Web Interface: FTMO introduced the DXtrade web interface in November 2023, expanding clients’ options and providing an additional alternative for traders looking for a user-friendly and efficient trading experience.

- FX Pairs Supported: I discovered that it supports EUR/USD, GBP/USD, GBP/JPY, USD/CAD, and AUD/USD.

Pros

Cons

Pricing:

The pricing structure for the FTMO trading platform is as follows:

| Data | Details |

|---|---|

| Initial Fee | The minimum initial fee to start trading with FTMO is £119. |

| Scaling Limit | Maximum of $5,760,000. |

| Profit Split | Up to 80%. |

| Maximum Allowable Drawdown | 5% |

Free Trial: It also offers a free trial of 14 days.

Profit-sharing Up to 90%

5) FXIFY

Best for maximize profits, and quick access

FXIFY is a superior choice based on my experience evaluating top prop trading firms. I could access different account sizes up to $400,000 and tailor each one with features I genuinely needed. As I evaluated the Instant Funding model, I saw how beneficial it was for active traders. This may help anyone seeking a quick start without waiting weeks for approvals. The best way to make use of this tool is by aligning your strategy with their prebuilt flexibility. Retail traders, for example, prefer FXIFY’s fast-track plans for testing new strategies without heavy financial risks.

Features:

- Instant Funding Access: FXIFY lets you skip the usual evaluation phase and begin trading real capital right away. You can start earning up to 90% of your profits from the first day. While testing this feature, I noticed it’s incredibly useful for experienced traders who want to avoid delays and get straight to executing their strategy.

- Starting Capital: You can choose from account sizes ranging from $5,000 to $400,000, which suits different trading levels. Accounts are scalable up to $4 million if you show consistent success. I suggest starting with a manageable size and scaling gradually to avoid unnecessary pressure.

- High Profit Split: FXIFY offers up to a 90% profit split, which is among the most generous in the industry. The standard rate starts at 80%, and you can boost it with add-ons. I’ve used this in comparison with FTMO and found FXIFY’s split more flexible and customizable.

- Full-Size Account Trading: The platform gives you direct access to full-size accounts with no throttling or artificial limits. This means you trade with the full power of your balance. There is also an option that lets you upgrade instantly, which I found helpful for capitalizing on high-confidence setups.

- Minimum Trading Days: To qualify and maintain your account, FXIFY requires a minimum of 10 trading days. This promotes discipline and ensures you don’t rely on short bursts of luck. I once tried to rush through it, but consistent pacing actually improved my results.

- Single Login Access: This unified login made managing multiple trading accounts easier than I expected. I used it to track performance across different strategies without switching between dashboards. You will notice it saves time, especially when working with both personal and prop firm accounts.

Pros

Cons

Pricing:

Here are the best pricing plans of FXIFY:

| Buying Power | Fees |

|---|---|

| $5,000 | $59 |

| $10,000 | $89 |

| $15,000 | $119 |

Profit-sharing Up to 90%

6) Goat Funded Trader

Best VIRTUAL Profit Target In The Market

I evaluated Goat Funded Trader allowed me to see what well-designed funding challenges should look like. I particularly appreciate the no time constraints and the option for on-demand payouts. That combination is rare and makes this a top-rated pick. With their one-time refundable fee and up to $2 million in simulated capital, this is one of the most effective platforms for skilled traders to prove their strategy.

Features:

- No Time Limit: Goat Funded Trader allows you to hold your evaluation account as long as you need to pass the challenge. This removed the usual pressure I felt with timed programs. While using this feature one thing I noticed was that pacing my trades based on market conditions, not deadlines, significantly improved my win rate.

- Daily Loss Limit: You’re given a generous daily drawdown cushion, like a $95,000 max loss on larger accounts. This helps manage risk while giving room for tactical trades. I suggest tracking your losses using a journal—small habits like this helped me stay consistently within safe ranges.

- Flexible Trading: You can use any trading style—scalping, swing, or algo. I appreciated the freedom to deploy my tested EA during live markets without interference. There is also an option that lets you hedge or trade news, which most firms restrict—this opened up high-volatility plays for me.

- Fast Trading: Order execution is quick and tied to real-time pricing. I personally ran high-frequency entries and got filled within milliseconds, which reduced my slippage drastically. This is ideal if you’re entering and exiting often in volatile sessions.

- High Profit Splits: Traders start at 80% profit share and can unlock up to 100%. I liked how earnings scale with your account without needing to requalify. It competes well with top-tier firms like FTMO, but offers more in earnings retention through add-ons.

- Payout on Demand: You can request your payout anytime and receive it the same day. I tested this after my first profitable week, and funds hit my wallet within hours. This flexibility supports real-time budgeting and builds trust with the platform.

Pros

Cons

Pricing:

Goat Funded Trader offers the following pricing options for its trading programs:

| Buying Power | Price |

|---|---|

| $5,000 | $30 |

| $8,000 | $48 |

| $15,000 | $88 |

| $25,000 | $138 |

| $50,000 | $238 |

Profit-sharing Up to 95%

Feature Comparison Table

How Did We Choose Best Forex Trading Prop Firms?

At Guru99, we are committed to providing accurate, relevant, and objective insights backed by a meticulous editorial process. After dedicating over 100 hours to evaluating more than 40 of the best Forex trading prop firms, we created a comprehensive guide highlighting key features, pricing, and pros and cons. Our content is crafted to support traders seeking reliable firms with strong infrastructure, fair policies, and sustainable profit potential. Each recommendation meets high standards for transparency, support, and growth. We focus on the following factors while reviewing a tool based on.

- Funding Structure: We chose based on how clearly the firm defines capital access and profit sharing for all users.

- Trading Rules: Our team selected firms with fair risk parameters that allow you to trade with ease and confidence.

- Platform Reliability: Experts in our team selected the tools based on stable, ultra-responsive platforms with hassle-free setup.

- Payout Process: We made sure to shortlist firms that consistently offer secure, rapid, and reliable payout solutions without compromise.

- Educational Support: We chose firms offering helpful resources, ideal for skill building and consistent improvement in a user-centric manner.

- Customer Service: Our team chose based on firms that provide smooth, timely, and knowledgeable support to solve problems effectively.

Verdict

When deciding on the best forex trading prop firms, I focus on trust, real-time conditions, and payout structures. I look for firms that provide capital without creating complexity in the evaluation process. These factors help me evaluate what is ideal for consistent growth and performance. Check my verdict.

- Funded Trading Plus: is perfect for traders seeking a reliable and flexible partner.With instant funding options, no time-limit evaluations, and payouts starting immediately, it stands out as one of the most trader-friendly prop firms in the market.

- FundedNext: A superior choice for diverse instruments and high profit splits up to 95%, offering one-step evaluation and impressive trading flexibility.

- TakeProfitTrader: A comprehensive prop trading firm offering up to 80% profit splits with funded accounts up to $200,000, featuring flexible trading rules, multiple account types, and support for both MT4 and MT5 platforms with no restrictions on trading strategies.