6 BEST GST Billing Software in India (2026)

Accuracy in tax compliance begins with the right digital tools. The best billing software in India empowers businesses to manage invoicing, file GST returns, and track finances with precision. As a veteran SaaS reviewer, I bring my insights to help you identify high-performing platforms that go beyond templates to provide automation, inventory tracking, and real-time financial clarity. This guide benefits SMEs, startups, and enterprises seeking reliable billing workflows. AI-powered billing systems are now enabling predictive expense tracking and auto-reconciliation.

Choosing the Best GST Billing Software in India requires more than just comparing features. After spending over 250 hours and reviewing 20+ options, I built this credible and professional guide. It includes transparent breakdowns, unbiased insights, and up-to-date recommendations. I once used a tool that automated multi-state GST filings so seamlessly it saved me hours—an efficiency many businesses still overlook. Read more…

Zoho Books is GST-compliant billing and invoicing software that allows a smooth billing process for businesses. It can calculate GST automatically. Zoho Books generates reports and lets you auto-populate GST for transactions.

Best GST Billing & Invoicing Software in India

| Name | GST Filing | Invoice Customization | Expense Tracking | Free Trial | Link |

|---|---|---|---|---|---|

👍 Zoho Books |

Yes | Professional templates, Client Portal | ✅ | Yes – 14 Days | Learn More |

FreshBooks |

Yes | Branded invoices, recurring billing | ✅ | Yes – 30 Days | Learn More |

myBillBook |

Yes | 8+ GST invoice templates | ✅ | Yes – 7 Days | Learn More |

Vyapar |

Yes | Multiple invoice themes | ✅ | Lifetime Free Basic Plan | Learn More |

Tally Prime |

Yes | Highly customizable | ✅ | Yes – 7 Days | Learn More |

1) Zoho books

Best for Integration with a variety of financial apps & services

Zoho Books is GST-compliant billing and invoicing software that I tested to see how well it supports small businesses. It helped me manage billing with GST regulations and simplified input credit tracking. I could instantly access GST billing data and calculate liabilities, which is great for on-time tax filings.

This billing and invoicing software allowed me to automate processes by integrating it with over 50 apps and services. I particularly appreciate the advanced accounting tools that helped me create purchase orders, track expenses, and more. The client portal is great for letting customers see their transaction history without delay. Consultants are using Zoho Books to streamline GST calculations and reduce compliance risks, helping them stay audit-ready throughout the year.

Tax management: Yes

Inventory management: Yes

Expense management: Yes

Free Trial: 14 Days Free Trial

Features:

- GST Return Filing: It can calculate GST automatically. Zoho Books generates reports and lets you auto-populate GST for transactions. It also provides protection for e-invoicing and ensures your GST filing is error-free.

- Easy Banking: This software lets you reconcile your accounts instantly. It can secure transactions imported from your bank and PayPal accounts. Zoho Books also helps understand mismatches, receive correct cash flow prediction, and more with its banking dashboard.

- Automated Tax Calculations: Zoho Books automatically applies the correct GST rates to every transaction, minimizing room for error. It recognizes intra-state and inter-state supplies based on address fields. I recommend double-checking HSN/SAC code mappings in your product settings for consistent accuracy across invoices.

- Reports: Zoho Books provides real-time financial reports including GST summary, balance sheet, and cash flow. I used it to automate my monthly tax summary emails to my accountant. You will notice the report scheduler is flexible—I suggest setting it to match your GST return filing cycle to avoid last-minute data collection.

- E-Way Bill Generation: You can generate e-way bills directly within Zoho Books, saving time and reducing manual entry. It syncs your invoice data to auto-fill most e-way bill fields. While using this feature one thing I noticed was how smooth it was to integrate with the NIC portal—just ensure API access is enabled in your settings.

- Customizable Invoice Templates: The tool lets you design GST-compliant invoices that align with your brand identity. You can add your logo, select fonts, and insert dynamic GST fields. There is also an option that lets you create bilingual invoice templates, which I found useful when working with clients across different regions in India.

Pros

Cons

Pricing:

Here are the monthly plans of Zoho Books that are billed annually

| Plan Name | No Bills and Expenses | Price per Month |

|---|---|---|

| Standard | 5000 | ₹749 |

| Professional | 10,000 | ₹1499 |

| Premium | 25,000 | ₹2999 |

Free trial: 14 days

14-Days Free Trial

2) FreshBooks

Best for Automating daily accounting activities

FreshBooks impressed me with how effortlessly it adapts to Indian GST billing needs. I evaluated several tools, and FreshBooks consistently delivered accuracy and ease. I found that you can create invoices, apply tax rules, and even categorize your revenue for quick reports. This billing and accounting software also lets you easily add your branding and custom styles to your invoices.

While conducting my evaluation, I appreciated its collaboration feature it allowed me to give access to my accountant without handing over control. In my opinion, FreshBooks is ideal for growing teams that want structure but not complexity. You can use its desktop and mobile apps to easily customize your invoice with easy-to-use tools.

Tax management: Yes

Inventory management: Yes

Expense management: Yes

Free Trial: 30 Days Free Trial

Features:

- Accounting and Taxes: Freshbook ensures accuracy and keeps your business compliant. It can track all expenses so you can see where you have been spending. It offers readymade finance reports that simplify taxes for you by keeping all your numbers in one centralized location. This GST accounting software also has a client portal to help clients see all their transactions with you.

- Bookkeeping: It provides you with expert bookkeeping and tax preparation. FreshBooks lets you create workflows that help you keep your finances flowing. This GST software helps import bank statements, reconciles accounts, and prepares your monthly statements.

- Invoice: You can use its invoice generator to create professional-looking invoices within seconds. It lets you personalize your invoices by helping you add your company logo and thank you email. Furthermore, it helps send estimates and quotations to clients, provides built-in support for recurring payments, and allows configuring schedules for late fees.

- Seamless Tally Integration: You can export your FreshBooks reports in formats that work smoothly with Tally ERP, which simplifies GST reconciliation. I once had to prepare quarterly returns, and syncing the data with my CA’s Tally system saved a lot of back-and-forth. The tool lets you customize the export type to match the Tally version your accountant prefers, which avoids mismatches.

- Multi-Currency Support: FreshBooks allows you to invoice in different currencies while automatically adjusting for GST and exchange rates. I used this while billing an overseas client in USD and found the GST auto-calculation incredibly accurate. I recommend reviewing the currency settings once a month to ensure you’re working with the latest conversion rates—this helps prevent underbilling.

Pros

Cons

Pricing:

Here are some of the plans of Freshbooks

| Plan Name | Pricing per month |

|---|---|

| Lite | $10.50 |

| Plus | $19 |

| Premium | $32.50 |

Free trial: 30 days

30-Days Free Trial

3) myBillBook

Best for Creating GST & non-GST bills

myBillBook is an intuitive billing and invoicing software that tracks business performance through extensive data-driven reports. During my analysis, I found its automated payment reminders to be a great way to ensure timely bill payments from customers.

It provides tools for inventory management with support for inventory tracking and low-stock reminders. One of its standout features is its ability to seamlessly manage and track business activities with fast, automatic syncing between desktop and phone. Moreover, data automatically gets backed up whenever the device has internet access.

Features:

- GST Invoicing: You can create professional invoices within a few clicks. It auto-populates all the required fields, such as GSTIN, GST rate, HSN/SAC code, and others. This platform offers more than eight GST invoicing formats for custom creation. All the information that you enter in myBillBook remains end-to-end encrypted.

- Easy Accounting: It is a free online accounting software that manages your overall finance-related work. myBillBook helps track expenses, send payment reminders, helps record sales and purchases, and more. It also maintains cash ledgers, party-wise ledgers, bank ledgers, and others. Ultimately, it helps generate records that are useful for GST invoicing.

- Business Reports: It is capable of converting all your business data into simple readable reports. You get above 20 reports using myBillBook. It can generate sales summaries, inventory reports, GSTR sales, purchase reports, and more.

- Customised Invoices: Customised invoices in myBillBook let you add your logo, brand colors, and preferred invoice layout. This gives your documents a polished, professional look that reflects your brand identity. I suggest using consistent colors and adding your GSTIN prominently to build trust with repeat customers.

- Expense Tracking: The expense tracking feature helps you log and categorize business expenses instantly. It offers a clear dashboard view that aids in understanding monthly cash flow trends. While using this feature one thing I noticed was how effective it is when linked to bank statements—this saves manual entry time and improves accuracy.

- Other Features: It supports multi-currency, offers expense management, and online banking integration. myBillBook can also deliver challan, collect payments faster, and much more.

Pros

Cons

Pricing:

Here are some of the plans of myBillBook

| Plan Name | Pricing per month |

|---|---|

| Diamond | ₹217 |

| Platinum | ₹250 |

| Enterprise | ₹417 |

Free trial: 7 days money back guarantee

Link: https://mybillbook.in/

4) Vyapar

Best for Lifetime free of cost invoicing features

Vyapar is billing software that allows you to create customizable bills, collect payments, and efficiently manage business expenses. I analyzed how it connects with your bank account, and you can manage your transactions through the Vyapar app. It also simplifies sending money and allows for easy bank-to-bank transfers, making it one of the best free invoicing software in India.

Vyapar is a free billing and invoicing software that also supports inventory management. I found that you can use its billing tools to ensure your invoices are GST-compliant. This billing and invoicing software allows easy quotations, budgeting, and invoice sharing. Its desktop app allowed me to monitor stock levels in real time. This free GST billing software also allows you to generate invoices with many different themes.

Features:

- Business Reports: It offers 37+ business reports to choose from. This software has professional balance sheets, and you can view and analyze the data instantly. It also helps you create graphical reports for tracking sales and expenses.

- GST Return Filing: This billing software helps you file GST, VAT, TDS, TCS, and many other taxes. It simplifies GST filing and lets you create GST reports effortlessly. You can create reports like GSTR1, GSTR2, GSTR3, GSTR4, and GSTR9. It lets you keep track of the GST bills that you create throughout the year and detects the GST applicable to the product.

- Payment Reminders: Vyapar makes it easy to automate payment reminders via WhatsApp, SMS, or email. You can schedule reminders so your clients never miss due dates. I suggest customizing the message templates for each client type to add a personal touch and improve response rates.

- Creating Invoices: You can use it to create invoices and do error-free accounting. Its invoices comply with all GST norms, and it lets you print these invoices in various formats. It offers dedicated Android and Windows application that helps you manage accounting on the go. Furthermore, it provides you with a seamless bookkeeping process.

- Data Backup and Restore: The tool automatically backs up your business data and offers seamless restore options. I’ve used this feature after a system crash and recovered all my billing records in minutes. There is also an option that lets you enable scheduled cloud backups, which I recommend activating to avoid accidental loss.

- Profit and Loss Reporting: Vyapar gives detailed profit and loss reports, breaking down income, expenses, and margins. I once used this feature during quarterly tax filing and saved hours of manual calculations. The reports are exportable, which helps when sharing data with a CA or financial advisor.

Pros

Cons

Pricing:

Here are the pricing plans of Vyapar

| Plan Name | Pricing/Year |

|---|---|

| Silver | ₹3999 |

| Gold | ₹4299 |

Free trial: Lifetime free basic plan.

Link: https://vyaparapp.in/

5) Tally Prime

Best for Managing multiple business functions like accounting, invoicing, and banking

Tally Prime is one of the most widely used GST billing software in India. I reviewed this easy-to-use e-invoicing software during my analysis of the best GST billing software in India. You can set up this GST accounting software in less than a minute, and it automates your tasks, providing you flexibility with its ability to adapt to any business.

This GST software can reconcile your books with GSTR-2A, GSTR-1, and GSTR-2B effortlessly. I was able to see how it reconciles data automatically, provides the reason for the mismatch, and flags unreconciled invoices. Tally Prime accounting software helps you optimize cash flow with many features to ensure timely client payments. Its prevention, detection, and correction technology ensures that your accounts are in the best condition for tax compliance.

Features:

- Invoicing and Accounting: It helps create professional-looking GST invoices in just seconds. You can personalize the invoices by adding your company logo, additional data, and more. Tally also offers an easy payment method with a QR code and link on its invoices.

- Tax and Compliance: Tally Prime removes the complexities of GST filling with its built-in error detector. It instantly generates e-invoices and can reconcile different GSTRs. Tally helps you stay audit trial compliant as per MCA guidelines.

- Reports: This GST billing software offers insightful and accurate reports. It comes with highly flexible reports that let you include and exclude data as you want. Tally Prime’s customizable reports allow you to evaluate the company on various parameters. It gives you very insightful, data-driven reports about multiple aspects of your business.

- Robust Security Features: Tally Prime offers detailed role-based access controls to ensure only authorized personnel handle sensitive data. It maintains comprehensive audit trails that track every user action. While using this feature one thing I noticed was how easy it is to identify unusual transactions during audits, which really helps improve accountability.

- Efficient Credit and Cash Flow Management: The tool simplifies tracking of receivables and payables, helping you plan better. I used it to manage credit limits across multiple vendors, and it worked flawlessly. I suggest enabling payment reminders and auto-reconciliation to avoid delays and improve liquidity control.

- Customizable Dashboards: You can tailor dashboards to highlight sales, inventory, or GST reports based on your focus. I customized mine to show overdue payments and top-selling items. There is also an option that lets you color-code metrics, which makes performance tracking visually intuitive.

Pros

Cons

Pricing:

Here are some of the plans for TallyPrime

| Plan Name | Pricing per month |

|---|---|

| TallyPrime Silver | ₹750 |

| TallyPrime Gold | ₹2,250 |

Free trial: 7 days

Link: https://tallysolutions.com/tally-prime/

6) Cleartax

Best For Quickly filing tax returns and making/sending invoices

ClearTax helped me organize my billing tasks faster than I expected. I evaluated it against other tools, and the user-friendly design made all the difference. It provides different products for the diverse needs of SMEs, individuals, tax experts, and enterprises. It allows you to generate GST invoices, automate filing schedules, and integrate with accounting software without steep learning curves. I suggest this platform for growing businesses aiming to digitize their billing operations.

This platform is the ideal invoice billing software for small businesses that provides integrations with most ERPs and ingests data quickly. This billing software will enable you to create, print quickly, and manage your bills. Keep in mind, a solution like this can greatly improve compliance tracking and reduce late penalties.

Features:

- GST Filing: Cleartax offers hyper-automation that ensures error-free GST filing. It helps you match up to 60,000 invoices in just a minute. This platform is powered by AI to help you find 100% tax credits. It offers high-end encryption with SSL, SOC2, and ISP certifications. You get complete accuracy on your GST as it is reviewed by over 60 experts.

- Tax saving Reconciliations: This GST software removes all errors and saves your customer’s money. ClearTax generates insightful, smart reports, creates and sends payment reminders as emails, and reconciles invoices by the vendor.

- Real-Time Data Sync with ERP: Cleartax connects directly with ERP systems like Tally and SAP for smooth GST invoicing. Data flows in real-time, eliminating manual entry and reducing reconciliation errors. I suggest enabling auto-sync scheduling to cut down data lags between systems and improve monthly GST filing efficiency.

- Invoicing and Payment: ClearTax comes with a fully integrated GST-compliant invoice creation. It tracks the payments and manages your stocks. ClearTax helps you print and share professional-looking invoices, maintain a mastery directory, manage inventory, and more. It also allows you to choose from various custom templates for invoices. ClearTax also uses 200+ validations to ensure your accounts are correct.

- Bank-Grade Security: Cleartax uses 256-bit SSL encryption to protect all financial transactions and login activity. It is compliant with SOC 2 and ISO 27001, which ensures enterprise-level data privacy. I’ve personally onboarded clients who were reassured after learning about these robust certifications.

Pros

Cons

Pricing: Contact support to request for quote.

Free trial: Free Signup and demo available

Link: https://cleartax.in/

Feature Comparison Table

Why do you need billing software?

Billing software helps small and medium businesses design professional-looking invoices very quickly. The best billing and invoicing software has features to manage your taxes, create recurring payments, remind customers of unpaid invoices, and more.

It also saves your time, maintains financial records, and ensures faster gains from your clients. Some online invoicing software may support recurring payments, GST calculations, proper invoicing, and business reports/statistics.

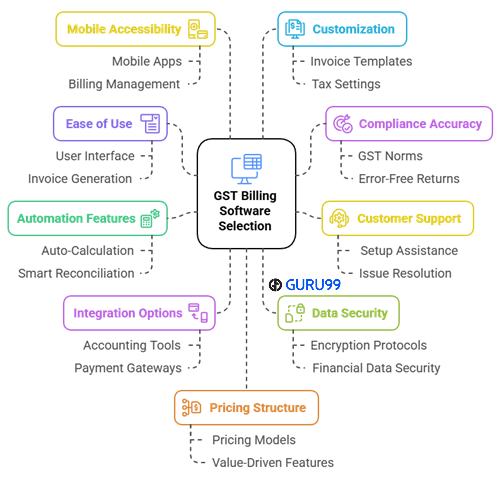

How Did We Choose Best GST Billing Software?

At Guru99, we are committed to delivering accurate, relevant, and objective information through a rigorous editorial process that ensures reliability and clarity. Selecting the best GST billing software in India goes beyond feature comparison—it demands solutions that simplify compliance, support dynamic tax rules, and enhance operational efficiency. After analyzing over 40 options across 100+ hours, we present a professional, transparent, and up-to-date guide designed for small businesses, retailers, and service providers. Our top picks offer seamless multi-state GST filings, reliable performance, and intuitive interfaces. We focus on the following factors while reviewing a software based on.

- Ease of Use: We chose based on how smoothly users can generate GST invoices without technical complications.

- Compliance Accuracy: Our team selected tools that consistently meet updated GST norms and ensure error-free returns.

- Customer Support: We made sure to shortlist platforms that offer responsive help for setup, queries and issue resolution.

- Automation Features: Experts in our team selected the tools based on their auto-calculation and smart reconciliation capabilities.

- Integration Options: We chose software that works with accounting tools and payment gateways for seamless operations.

- Data Security: Our team prioritized solutions that ensure your financial data remains secure, backed by encryption protocols.

- Mobile Accessibility: We selected options that offer mobile apps so you can manage billing from anywhere with ease.

- Customization: We chose tools that allow invoice templates, tax settings and fields to be customized for different needs.

- Pricing Structure: We focused on software that offers fair pricing models and value-driven features for all business sizes.

Benefits of Using A Robust GST Billing Software

Choosing the right GST billing software can truly change how you run your business. From my experience, I’ve seen small shops to large firms gain real advantages just by switching to a reliable system. A strong GST billing solution doesn’t just handle tax—it improves how you work every day. It reduces manual tasks and cuts down errors. This makes your business more compliant and your workflow much smoother.

Good software also keeps you updated with the latest GST rules. That means fewer penalties and faster filing. It’s especially helpful for beginners who don’t fully understand all GST requirements yet. When systems are easy to use, it builds confidence and saves time.

- Time Saving: Automated invoice creation, tax calculation, and return filing free up your time.

- Error Reduction: Built-in checks help catch mistakes early, avoiding costly corrections.

- Compliance Support: Regular updates help you stay aligned with the latest GST norms.

- Professional Look: Neat, GST-compliant invoices boost trust with clients and vendors.

- Easy Reporting: Ready-to-use reports make analysis simple during audits or reviews.

Verdict

When I need to streamline my billing, staying compliant with GST and keeping my records flawless, I do not settle for average tools. I always go for billing software that aligns with accuracy, reliability, and ease of use. If you are deciding, check my verdict below.

- Zoho Books: Zoho Books is a comprehensive and secure billing tool that integrates with over 50 platforms, making it ideal for businesses that want a customizable and user-friendly solution for automated tax handling.

- FreshBooks: A top-rated platform with flexible invoice customization and strong bookkeeping features, providing a robust and reliable foundation for managing day-to-day GST billing operations.

- myBillBook: This is a powerful and cost-effective tool with smart reporting and offline support, offering the greatest value if you want seamless data syncing between mobile and desktop.

Accounting software like QuickBooks Online provides several benefits that enhance efficiency and accuracy. Automating tasks such as sales tax rate updates and manual calculations allows businesses to reduce time spent on tax-related activities.