Foreign Currency Revaluation in SAP: Month End Closing

Before creating Financial Statements, we have to perform Foreign Currency Valuation for the Transaction done in Foreign Currency .

These transactions can be bills receivables or bills payable or might be inter company money transfers which involves G/L Accounts, Customer or Vendor.

The Line items can be open or cleared .

For the Line items which are cleared the exchange rate would be that of the date on which it is cleared .

For Open Items which are not yet cleared the exchange rate may be considered as the current rate or can be considered as month end exchange rate and can be carried out as a monthly closing activity .

So at the year end, there could be some revenue or expense due to exchange rate fluctuations which will be reflected in the Financial Statements.

Expense and Revenue Accounts for exchange Rate differences can be maintained in Customizing transaction code SPRO. In the SAP we can carry out Foreign Currency Revaluation in the following manner :

Foreign Currency Revaluation Configuration in SAP

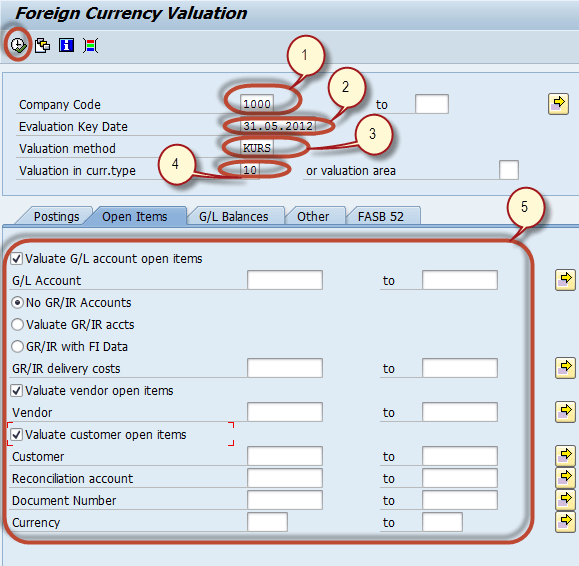

Step 1) Enter Transaction Code F.05 in the SAP Command Field

Step 2) In the next screen, Enter the Following

- Enter Company Code for which Foreign Currency Valuation is to be carried out

- Enter Evaluation Key Date

- Enter Valuation Method for Exchange Rate Consideration

- Enter Valuation in Currency Type ( Default is 10 : Company Code Currency)

- You can filter out Valuation activity by entering appropriate parameters in the Tab Screens.

Press Execute

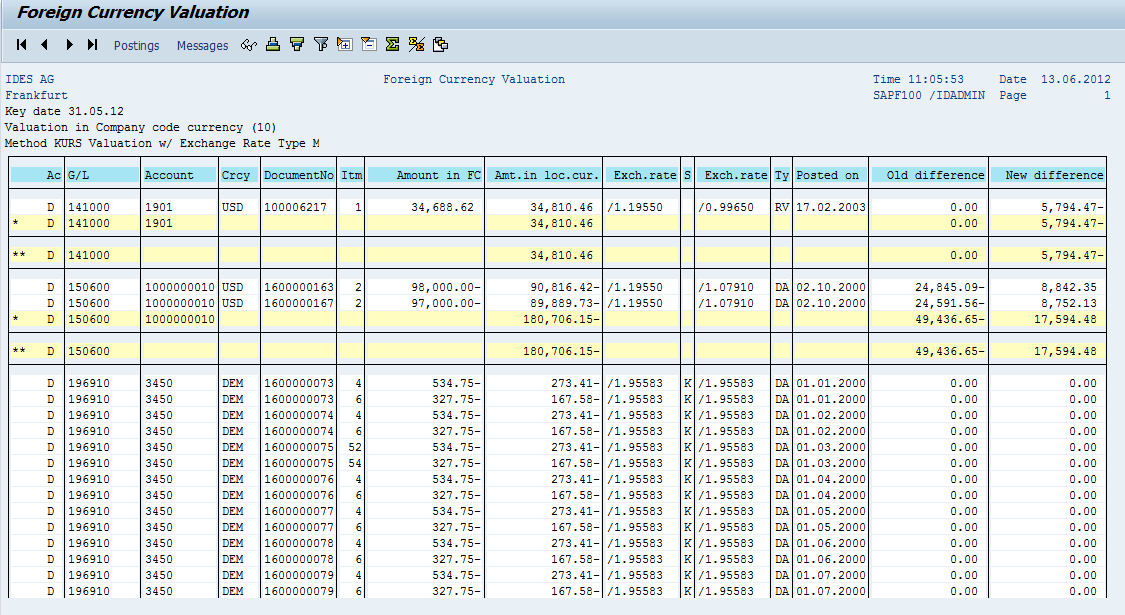

Step 3) In the next screen, a list of G/L Accounts is generated which are selected for the Foreign Currency Valuation by the Report SAPF100. It evaluates the open items in foreign currency as well as foreign currency balance sheet accounts.