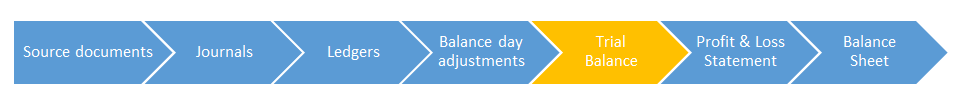

How to Prepare Trial Balance with Example

What is Trial Balance?

The Trial Balance is, as the name suggests, is a table where we lay out all our debit accounts and all our credit accounts to see if they balance or not.

A trial balance is important because it acts as a summary of all of our accounts. By looking at our trial balance, we can immediately see our bank balance, our loan balance, our owner’s equity balance. In fact, we can immediately see the balance of every single account in our business.

Why Trial Balance is important?

Well, as you know, accounting/bookkeeping is all about balancing. The accounting equation needs to balance, every transaction needs to be balanced, our debits and credits need to be balanced and so on.

A trial balance is the accounting equation of our business laid out in detail. It has our assets, expenses and drawings on the left (the debit side) and our liabilities, revenue and owner’s equity on the right (the credit side). We can see everything clearly and make sure it all balances.

A trial balance that balances tells us that we’ve done all our journals and ledgers correctly. it’s saying, “All your transactions for the year have been entered, and, everything looks right!”

As you may have already guessed, in the real world trial balances do not always balance the first time. As with anything, human errors will occur, and somewhere along the line, someone is likely to have entered a bad journal or processed a ledger incorrectly. Therefore at the trial balance stage accountants and bookkeepers are often forced to go back and review vouchers, journals, and ledgers to locate the errors and bring the accounts back to balance. This shows the importance of producing a trial balance in the first place – it tells the user that the accounting equation is out of balance and it needs to be fixed before going any further.

Producing the trial balance is the final step of data processing – after that, we can start producing our financial statements!

Formula of Trial Balance

The formula of trial balance is total debits = total credits.

How to Prepare a Trial Balance

First of all, we take all the balances from our ledgers and enter them into our trial balance table. Remember the accounting equation:

| DEBIT SIDE | CREDIT SIDE |

|---|---|

| Assets + Expenses + Drawings | Liabilities + Revenue + Owners Equity |

Below is a list of all of our balances from our ledgers. You have calculated these balances in tutorial 8. Now you need to place them on the trial balance to see if they fit into the accounting equation!

Example of Trial Balance Sheet

| Debit Side | Credit Side |

|---|---|

|

Liabilities

|

|

Expenses

|

Revenue

|

|

Drawings

|

Owners’ Equity

|

|

my

|

my

|

||

|

my

|

my

|

||

|

my

|

my

|

||

| Total Balance |

|

Total Balance |

Wow. You’ve just balanced your first trial balance. We now know that all our numbers are correct, and can start compiling financial statements! Take a break and celebrate with a bowl of fries and a chocolate milkshake. You deserve it!