What is Drawing Expense in Accounting? Definition & Example

What is Drawings in Accounting?

As the owner, you will put money into the business from time to time. For example, on the day the business started, you would’ve deposited some of your own money into the business. This means you can also take money out of business.

For example, imagine one day you’re running late for dinner with your mother. As you’re running down the street to the restaurant, you realize in your panic that you’ve forgotten your wallet!

There’s no way you can go back home; it’s an hour away! Then you realize the bakery is just around the corner. You quickly pop over and take $100 out of the cashier.

This $100 will be recorded as drawings. Drawings are any amount the owner withdraws from the business for personal use.

Drawings are only a factor in smaller, owner operated (proprietor) businesses. Large companies and corporations will not deal the issue of drawings very often, simply because owners can be quite detached from day to day running of the business. While it easy to account for drawings in a small business such as a bakery, it is impossible for a Microsoft shareholder to simply go into a Microsoft store and take a bundle of cash as drawings! In such cases, owner’s receive money from the business via dividends or a shareholder’s salary.

What is Revenue in Accounting?

Revenue is money your business receives from its normal business activities. When the old man with a top hat comes in each morning and hands over $5 for his slice of cream cake, that $5 is considered to be revenue. Sometimes, revenue is referred to as turnover.

Remember, not all money you receive is revenue. Revenue is money received from the sale of goods or services.

Consider the following:

Your friend Jane meets a handsome boy at the gym. The next day, the boy calls Jane and asks her on a date. However, Jane has no money to buy a dress!

Jane borrows $100 from the bank so she can buy a dress for her date, which charges her interest of 10%.

A week later, Jane pays the bank back it’s $100 and the additional $10 in interest. Hence the bank receives $110.

How much of the $110 is revenue?

Remember revenue is only money received from business activities. Therefore, Jane’s payment of $100 is not from the sale of goods or services. It is simply repayment of the $100 the bank lent to her in the first place.

However, the $10 in interest arises as a payment for the service of providing the loan. Hence, of the $110 paid to the bank, only the $10 interest is considered revenue.

What is Expenses in Accounting?

The basic definition of an expense is money you spend to run your business.

For example, to run your bakery, you need to pay for much more than just cake mix. You need to pay rent to Arnold the landlord each month. You need to pay for repairs to the delivery car every time you ding your bumper in the parking lot. And you need to pay for internet so you can check how many likes you have on the bakery’s Facebook page. All these things you are paying for are examples of the business’s expenses.

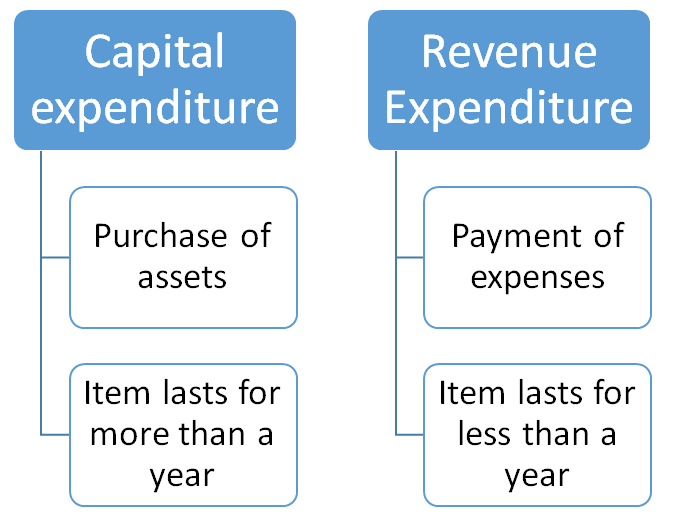

An important characteristic of an expense is that it is a cost which does not result in the acquisition of an asset.

For example, purchasing a car is not an expense. It is the purchasing of an asset, which we refer to as capital expenditure. However, purchasing of insurance and gasoline for the car are examples of expenses, which is known as revenue expenditure. We can loosely define capital expenditure as purchasing something that lasts for more than one year, while revenue expenditure is the purchase of something that lasts for less than one year.

Go through the following transactions and see if you can distinguish between capital and revenue expenditure.

Example 1:

You purchase a new oven for $1,000 for your bakery.

Your new oven breaks. You hire a repairman $50 to fix it.

Revenue Expenditure Capital Expenditure

You decide to furnish your store. You purchase 5 sets of tables and chairs at a total cost of $2,000.

Revenue Expenditure Capital Expenditure

Revenue Expenditure Capital Expenditure

Revenue Expenditure Capital Expenditure

This is all about Revenue, Expense and Drawing in Accounting/Bookkeeping.