How to Trade Bitcoin Options?

Bitcoin Derivatives are tradable securities or contracts which derive their value from underlying assets (Bitcoin spot rate). Bitcoin Future and Options are now among the most common financial products on any cryptocurrency exchange or trading platform, thanks to increased interest among the crypto trading community. Various Bitcoin derivatives products include Swaps, Futures, Forwards, Options, and Perpetual Futures.

Trading crypto derivatives has its advantages as it allows users to mitigate volatility-associated risks and hedge against potential losses. Read more…

How to Trade Bitcoin Future & Options using Crypto Exchanges

Crypto derivative exchanges offer dashboards for trading history, recent trades, and order books. Here is a list of the Top Bitcoin Derivative Exchanges. This list consists of paid and open-source tools with popular features and the latest download links.

| Name | Binance | PrimeXBT | Kraken |

| Supported Coins | 30+ cryptocurrencies | BTC, ETH, XRP, LTC, and multiple altcoins | XBT, ETH, LTC, BCH, and XRP |

| Fee | Taker fee is 0.075%, maker fee is 0.025%. | Starting at 0.05% per trade | Maker fee is 0.02%, taker fee is 0.05%. |

| Leverage | Up to 125x | Up to 1000x | Up to 50x |

| Withdrawal | Under 30 minutes | Fast processing with secure verification | Transfer to Futures Holding wallet |

| Daily Turnover | 4 Billion | High liquidity platform | N/A |

| Support options | Live Chat & Email | Live Chat, Email & Knowledge Base | 24/7 live chat |

| Deposits | Bank Deposit, Credit/Debit Card: Visa and Mastercard, P2P Trading | Cryptocurrency deposits | Bank transfer, credit/debit cards |

| Mobile Apps | iOS, Android | iOS, Android | iOS, Android |

| Geo Restrictions | Not allowed for USA. | Not allowed in certain jurisdictions including USA | Not allowed in Afghanistan, Congo-Brazzaville, Congo-Kinshasa, Cuba, Iran, Iraq, Libya, and North Korea. |

| Verification | Address and identity verification. | KYC verification required for full access | Need documents that reflect the country of residence |

| Link | Learn More | Learn More | Learn More |

How to trade Bitcoin Futures & Options

Step 1) Register a free Binance account.

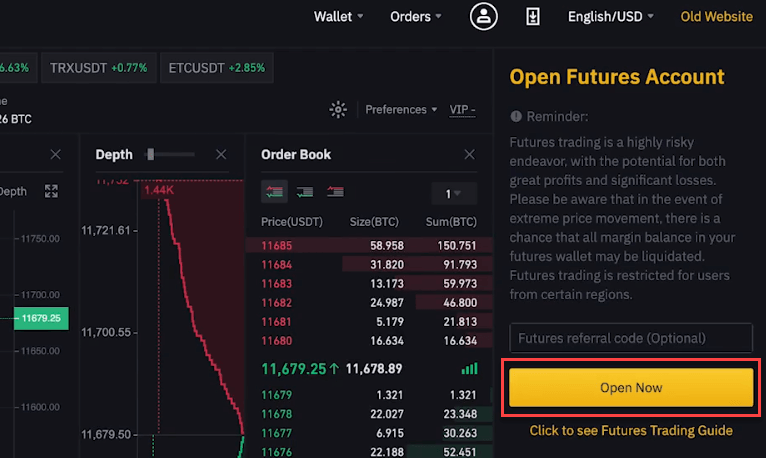

Next, click open now to activate your trading account.

Step 2) Choose a contract you want to trade.

Step 3) Adjust the position mode.

And select hedge mode and set leverage multiplier.

Step 4) Transfer asset into the future account

If you want to transfer used to spot, you can transfer using Binance. You can also transfer to a coin margin account if you want to trade coin margin.

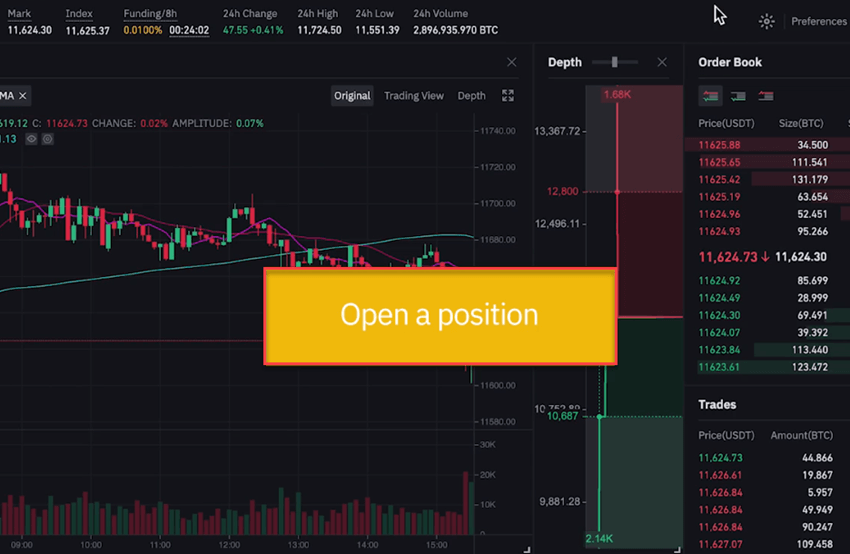

Step 5) Open a position,

You can see binance support various order types like limit, market, and stop limit.

Step 6) Monitor your position.

All your positions are given bottom of the screen; you can check them.

Step 7) Close your position.

You can do this by selecting the limit close or market-close option. You need to select a one-way mode.

Step 8) Under the hedging mode

1) You need to select the close tab.

After this step, you are all set for trading.

1) Binance

Binance is one of the best crypto derivate exchanges. It offers a platform for trading more than 150 cryptocurrencies. This online exchange has an API to integrate your current trading application.

At Binance, enjoy competitive trading fees with a 0.075% taker and 0.025% maker rate, up to 125x leverage, and swift withdrawals in under 30 minutes. Daily turnover hits $4 billion, supported by diverse deposit options, including bank transfers, Visa/Mastercard, and P2P trading.

Features:

- It is one of the top cryptocurrency exchanges that provide 24/7 support.

- This application offers a wide range of tools for bitcoin options trading online.

- It has a P2P exchange, spot, and futures.

- Offers both basic and advanced exchange interfaces for trading.

- Supported Coins for derivatives: 30+ cryptocurrencies.

- Geo Restriction: Not allowed for USA

- Verification: Government ID card and address verification for KYC.

- Mobile Apps: iOS, Android.

- Support: Live Chat & Email

2) PrimeXBT

PrimeXBT is a powerful multi-asset trading platform that provides advanced tools for trading Bitcoin futures and options alongside traditional markets. This platform combines sophisticated charting capabilities with high leverage opportunities, making it ideal for experienced traders seeking to maximize their derivatives trading strategies.

PrimeXBT offers competitive trading with low fees starting at 0.05% per trade, leverage up to 1000x on select instruments, and fast order execution. The platform supports multiple cryptocurrencies and provides advanced risk management tools for futures and options trading.

Features:

- Advanced trading platform with integrated TradingView charts and over 100 technical indicators for precise market analysis.

- High leverage trading up to 1000x on Bitcoin and other cryptocurrency derivatives.

- Copy trading functionality through Covesting module, allowing beginners to follow successful traders’ strategies.

- Multi-asset support including crypto futures, forex, commodities, and stock indices from a single account.

- Fast order execution with millisecond-level matching engine for optimal trade timing during volatile markets.

- Supported Coins for derivatives: Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and multiple altcoins.

- Geo Restriction: Not allowed in certain jurisdictions including the USA.

- Verification: KYC verification required for full account access and higher withdrawal limits.

- Mobile Apps: iOS, Android.

- Support: Live Chat, Email, and comprehensive knowledge base.

3) Kraken

Kraken is one of the most trusted crypto derivatives exchange companies. It offers financial stability by maintaining full reserves, relationships, and the highest legal compliance standards.

At Kraken, enjoy competitive trading with a 0.02% maker fee and a 0.05% taker fee, leverage opportunities up to 50x, and seamless fund transfers to your Futures Holding wallet.

Features:

- It offers a highly comprehensive security approach.

- Allows you to buy and sell assets in a single click.

- Kraken automatically checks all addresses for errors.

- One of the most trusted crypto derivatives exchange

- Supported Coins for derivatives: XBT, ETH, LTC, BCH, and XRP

- Geo Restriction: Not allowed in Afghanistan, Congo-Brazzaville, Congo-Kinshasa, Cuba, Iran, Iraq, Libya, and North Korea.

- Verification: Need documents that reflect the country of residence

- Mobile Apps: iOS, Android.

- Support: 24/7 live chat

4) Bybit

Bybit’s advanced trading system is ever-reliable with No Overloads and a 99.99% availability track record since inception. It offers an advanced order system where traders can set TP/SL for entry orders.

Bybit offers competitive trading terms with a 0.075% taker fee and a 0.025% maker rebate, up to 100x leverage, and thrice-daily withdrawal processing. It boasts a daily turnover of $700 million and accepts cryptocurrency deposits.

Features:

- Advanced mark and index pricing system provides the most reliable prices.

- Variety of platform data shown in real time to remain transparent to the users.

- Encrypted and secure platform.

- Supported Coins for derivatives: Bitcoin, Ethereum, Ripple, EOS.

- Geo Restriction: Worldwide, except United Kingdom, USA, Australia, Europe, Netherlands, Finland, Sweden, Denmark, and Norway

- Verification: No KYC verification is needed. Enter your phone number or email address, then verify your number or email address.

- Mobile Apps: iOS, Android.

- Support: Live Chat & Email

5) Deribit

Deribit is a great exchange for crypto futures and options trading. It comes with a no-fee deposit and free withdrawals. It allows buying and selling of Bitcoin futures and settlement options.

At Deribit, traders enjoy competitive fees with makers receiving a rebate of 0.02% and takers charged only 0.05%, alongside a 0.04% rate on options. The platform offers substantial 100x leverage, with crypto being the exclusive deposit method. Withdrawals are efficiently processed within three days.

Features:

- Low trading fees

- It offers dashboards for trading history, recent trades, and order books.

- Allows test exchange to get training in crypto bitcoin derivatives.

- It has statistics for futures, index, volatility, and technical indicators.

- Supported Coins for derivatives: BTC or ETH.

- Geo Restriction: Not allowed in USA.

- Verification: Need documents that reflect the country of residence.

- Mobile Apps: iOS, Android.

- Support: Telegram and Email

Link: https://www.deribit.com/

6) BitMEX

BitMEX is one of the best cryptocurrency exchanges and platforms. This web-based crypto derivative application offers a comprehensive API that helps investors to access financial markets using Bitcoin.

At BitMEX, enjoy competitive trading fees with a maker fee of 0.025% and a taker fee of 0.075%, along with the option to leverage up to 100 times. Your withdrawals are securely connected to your Bybit wallet address, and deposits are exclusively in crypto.

Features:

- This application constantly audits the balance and history of all accounts.

- It provides multi-factor security inside-out.

- Bitmex keeps all funds in cold storage for security.

- The perpetual contract of BitMex may trade at a significant premium or discounted rate to the Market Price.

- Supported Coins for derivatives: Bitcoin, Ethereum, Litcoin, Cardano, EOS, Ripple, etc.

- Geo Restriction: Not allowed in Hong Kong, Bermuda, and Seychelles.

- Verification: Not needed

- Mobile Apps: No

- Support: Mail only

Link: https://www.bitmex.com/

7) OKX

OKX is a cryptocurrency exchange that provides advanced financial services to traders globally by using blockchain technology. This crypto exchange offers hundreds of tokens to help traders to optimize their crypto derivative strategies.

OKX offers competitive trading with a standard taker fee of 0.075% and a maker fee of 0.025%. Traders can leverage their positions up to 100x, and the platform exclusively supports crypto withdrawals and token trading deposits.

Features:

- OKX provides a safe, reliable, and stable environment for digital asset trading via the web interface.

- Increases the efficiency of transactions across society.

- The support team provides a fast resolution to your query.

- It helps you to trade cryptos instantly and at a low price.

- You can join the conversations on OKX worldwide communities.

- Supported Coins for derivatives: Bitcoin (BTC), Ether (ETH), and Litecoin (LTC).

- Geo Restriction: Not allowed in Bangladesh, Bolivia.

- Verification: No verification is required to trade.

- Mobile Apps: iOS, Android.

- Support: Live Chat, Ticket, and Email.

Link: https://www.okx.com/

Find Your Perfect Crypto Wallet

Not sure where to start? Answer 5 simple questions, and we’ll recommend the ideal crypto wallet or exchange that matches your needs, whether you’re a long-term investor, a daily user, or a savvy trader.

Which Crypto Wallet/Exchange is Right for You?

Answer these five questions to find the perfect crypto wallet/exchange.

Your Recommended Wallet:

What are the types of Bitcoin derivatives?

There are mainly four types of Bitcoin derivatives:

- Perpetual contracts: These contracts are a clone of crypto futures contracts. Traders can hold a position as long as they have enough funds. Perpetual contracts are more suitable than futures trading for the people who needs to invest after every hour to keep the position open. Perpetual contracts help you combine the intuitiveness of spot trading with the futures market’s risk hedging.

- Options: By integrating options into your derivatives trading exchange allows traders to buy or sell an underlying asset at the pre-determined strike price in the specific timeline. They may take a call or a put option. In options (buying), traders are under no obligation to exercise the option as in the case of futures. They simply have an option at hand.

- Swaps: Traders use swaps to exchange one type of crypto derivate with another. This helps them to earn profit at a fixed time later.

- Forwards: Forwards is nothing but resembles futures, however, with a difference. Forwards can be customized, unlike futures. Forwards are generally traded through OTC (over the counter), so you need to consider the associated risks.

Can you explain bitcoin future and options in simple terms?

Let’s learn this with the help of the following example.

- Imagine you want to speculate on the price of gold. You could go and physically purchase bars of gold and sell them when prices have moved up.

- However, that is almost impractical and costly as you would also need to consider storage and transportation fees. Here better approach would be to trade an instrument or contract whose price is indexed to that of gold instead.

- These contracts are agreements that help you sign with an opposing party. It also helps you imagine that you are assuming the price will go up while another person believes the price will go down.

- You and another speculator can sign an agreement declaring that after a certain period when the price has moved in any direction, one party needs to pay the other the price difference.

- For example, the price of BTC is at $1000, and you assume that it will rise. Your counterparty bets it will go down. However, the price moves to $11,00 by the time you require to settle the contract. The opposing trader will pay you the difference of $1,00 only.

- Assume the opposite happens, and the price goes down to $900; you will have to pay $1,00. As you can see in such a deal or contract, an investor or trader can profit even when prices go down without having to own the underlying asset.

- Though this is how derivatives work in the context of trading, it comes with many unique variations in reality. The widely popular derivatives in the cryptocurrency industry are futures & settlement options and perpetual contracts.

What should you look for before joining crypto derivatives exchanges?

It is important to search for the best crypto derivative exchange before you start trading.

Here are some important steps you need to check before selecting a crypto derivate exchange.

- Reputation: The best way to find out about an exchange is to search using various reviews from individual users and with the help of well-known industry websites.

- Trading Fees: Many crypto derivate exchanges should have fee-related information on their websites. Therefore, before joining, you need to make sure you understand deposit, transaction, and withdrawal fees. Trading fees might differ upon the exchange you use.

- Payment Methods: You need to find out what payment methods are available on the exchange? Are they accepting Credit cards or Debit cards? Can you trade with USD, EUR, etc.

- All these details are important as if it has limited payment options, which may not be convenient for you to use them. You need to remember that buying cryptocurrencies with a credit card always demands identity verification. It also costs you a premium price.

- There is a bigger risk of fraud and higher transaction and processing fees. Buying cryptocurrency using wire transfer will take significantly longer as it takes time for banks to process.

- Verification Requirements: The majority of Bitcoin trading exchanges require ID verification to make deposits and withdrawals. However, some trading exchanges also allow you to remain anonymous.

- Most of them ask for verification, which may take some time. It helps you to protect the exchange against all kinds of scams and money laundering.

- Geographical Restrictions: Some functions offered by cryptocurrency exchanges are only accessible from specific countries. You should also make sure the crypto derivatives exchange you want to join provide full access to all platforms and functions in the country you are currently in.

- Exchange Rate: Various exchanges have different rates. So you need to search derivate exchange which provides an exchange. You will be surprised how much you can profit if you use the exchange. It is common for rates to fluctuate up to 10% and even higher in some instances.

- Support & Tutorials: Many crypto traders have developed training modules, videos, and blogs to educate their users. If you are new to trading, you can go through such a source to get a better idea of the tool. This will also help you to save valuable time while trading currency.

- Crypto Tax Software Integrations: It is easy to rack up your high number of trades when you trade with crypto bots. If you do not have the right software, reporting your crypto profit and loss on your taxes is challenging. It is crucial to look at the crypto tax software companies compatible with your desired Crypto trading bot platform. Having good crypto tax software that supports your crypto trading strategy can make your tax reporting easy.