7 Best Crypto Exchange in Singapore (2026)

Cryptocurrency exchanges have taken the world by storm in recent years, and Singapore is certainly no exception. With a rising interest in digital currencies and blockchain technology, more and more people are looking for the best crypto exchange to get into this exciting new space. But as with any investment venture, choosing the right one to trade on can be highly daunting! Here are the best crypto exchanges in Singapore.

After spending over 110 hours comparing 55+ platforms, I have carefully evaluated what makes a crypto exchange safe, scalable, and user-centric. This transparent breakdown reveals Singapore’s best crypto exchange options with verified pros and cons, exclusive features, and current pricing. I once used a local platform that lacked liquidity, which highlighted the need for credible, well-researched alternatives. This may help both new and professional traders make trusted, up-to-date decisions. Read more…

Zengo is the most secure non-custodial wallet in Web3 by removing the private key vulnerability, making it the simplest yet most secure wallet to invest in cryptocurrency.

Best Crypto Exchange in Singapore: Top Picks!

| Tool | Best feature | Deposit fee | Withdrawal fee | Link |

|---|---|---|---|---|

👍 Zengo |

Keyless Software to make quick Crypto Purchases | $0 (Free) | No Fee | Learn More |

👍 Uphold |

Best for multi-asset trading | $0 (Free) | No Fee | Learn More |

Kraken |

Easy-to-use interface and beginner-friendly | $0 (Free) | Depends on the Cryptocurrencies | Learn More |

Zoomex |

Best for secure and fast crypto | $0 (Free) | Depends on the Cryptocurrencies | Learn More |

Binance |

Convenient for experienced traders. | $0 (Free) | Fiat fee, depending on the blockchain network commission. | Learn More |

Choose a safe and secure crypto exchange in Singapore with low trading fees, an easy-to-use interface, and compatibility with the Singapore financial institutions you’d like to interact with.

1) Zengo

Best Keyless Software to make quick crypto purchases

Zengo is a highly reliable Web3 wallet that I reviewed recently. I was able to create an account in under a minute, which makes it perfect for beginners. What impressed me most was the 3-Factor Authentication that replaces traditional private keys, eliminating major risks. It allows you to be the true owner of your assets while keeping them recoverable through a secure 2-step process. During my analysis, I found that the wallet’s 24/7 human support and wide asset support make it a superior choice for crypto users. One of the best features is the peace of mind it offers in an often volatile market. Case study: Many NFT traders choose Zengo for its security-first design, ensuring seamless access and recovery even when switching devices.

Coins Supported: 1000+ including BTC, ETH, USDT, USDC etc.

Type of Wallet: Non-custodial

Price: Free

Features:

- Keyless 3-Factor Security & Integrated Web3 Firewall: Zengo replaces fragile seed phrases with battle-tested Multi-Party Computation, eliminating single-point key risk. Three factors-3D FaceLock biometrics, an encrypted cloud backup, and your email-shield every withdrawal and dApp approval, while the firewall flags suspicious smart-contract calls. I watched FaceLock reject a spoof image, confirming the protection.

- All-in-One Buy, Sell, Swap & Store for 1000+ Assets: Buy, store, swap, send, and receive more than 1000 cryptocurrencies straight from your phone. I grabbed Bitcoin with a Visa card and seconds later swapped it for SOL without leaving the app. Global payment rails, including SEPA and SWIFT bank transfers, keep Singapore traders liquid and fast.

- Flexible Network Fees-Economy, Regular, Fast: Zengo lets you choose economy, regular, or fast network fees on every Bitcoin, Ethereum, or ERC-20 transaction. I suggest tapping Economy during quiet network hours; the savings stack up without delaying confirmations noticeably. Advanced users can even enter a custom gas price for fine-grained control.

- One-Tap Cancel or Speed-Up for Pending Sends: One tap stops or accelerates it directly from the history screen-no technical gymnastics required. I cancelled an over-priced ETH send and immediately resubmitted at a lower fee, saving gas and nerves. The wallet handles the replace-by-fee logic behind the scenes.

- Staking Capabilities: With Zengo, you can stake Ethereum and Tezos to earn passive income, all within a few taps. This is ideal for users in Singapore looking to grow their crypto portfolio without trading actively. I tested Tezos staking on the app, and rewards were credited reliably without requiring external delegation. There is also an option that lets you track staking returns in real time, which helps with planning long-term investments.

- Live Human Support 24/7, Right Inside the App: Help is never a ticket queue away. Real agents answer chat around the clock, guiding newcomers through first swaps or troubleshooting obscure contract addresses. During a late-night DeFi approval I queried support and received clear, step-by-step instructions within two minutes, turning a potential panic into confidence.

Pros

Cons

Trading Fees:

Deposits, withdrawals, and account openings are all offered at no cost.

Free Wallet

2) Uphold

Best for trading and discovering new tokens

Uphold is a user-centric global crypto exchange I tested while analyzing beginner platforms for crypto trading. I found that the signup process was fast and the navigation was very intuitive. During my analysis, I noticed that the absence of margin trading and NFTs actually helped avoid confusion for first-time investors. It is important to highlight that the platform maintains SOC 2 and ISO 27001 certifications, giving peace of mind to users. I advise choosing Uphold if your priority is simplicity with strong backend security. Case study: Real estate consultants are starting to lean on Uphold to transfer cross-border crypto funds securely, helping clients diversify globally.

Coins Supported: 250+ crypto including BTC, ETH, XRP, HBAR, XLM etc

Type of Wallet: Custodial wallets

Price: Free

Features:

- Transparent Fee Structure: Uphold uses a spread-based fee model, which means users pay the difference between the buy and sell price rather than a fixed transaction fee. This makes costs predictable and easy to calculate upfront. There are no hidden charges, which builds confidence, especially for beginners. You will notice that price quotes are locked in for 15 seconds, giving just enough time to review a trade before committing.

- Uphold Vault: Uphold Vault is their assisted self-custody solution. It lets users control their private keys without the stress of managing them entirely alone. Multi-key security adds an extra layer of protection and offers recovery options if access is lost. While testing this feature, I appreciated how the interface guided me through secure key storage without overwhelming technical steps.

- USD Interest Accounts: Users in Singapore can hold USD in FDIC-insured accounts and earn up to 4.5% APY, which is a rare offer among global exchanges. It’s ideal for those who want crypto exposure while keeping some funds in a stable, interest-bearing format. I suggest activating auto-conversion to USD when market volatility rises—this helps protect your gains while still earning interest.

- Early Access to New Tokens: Uphold often lists promising tokens before they hit major exchanges. This gives users a competitive edge in accessing new projects early. I personally bought a mid-cap token here before it gained traction on other platforms. That early access made a real difference in portfolio performance.

- Cross-Border Transactions: Sending crypto or fiat globally with Uphold is straightforward and fast. I’ve used it to transfer funds between Singapore and the U.S. in under five minutes. The platform supports multiple currencies and offers live exchange rates. There is also an option that lets you lock in the FX rate before sending, which protects against price swings.

- Curated Crypto Baskets: Uphold’s themed baskets—like “The Big Three”—are designed for users who prefer structured investing. They allow you to diversify with one click by targeting a group of top-performing assets. I tested this feature during a volatile market phase, and it helped balance gains and losses across my holdings.

- Real-Time Asset Transparency: Every 30 seconds, Uphold updates a live dashboard showing assets and liabilities. This unmatched transparency gives users confidence in the platform’s solvency. I’ve cross-checked it during market events, and the numbers always aligned with public blockchain data. That level of openness sets Uphold apart from many other exchanges.

Pros

Cons

Trading Fees:

Uphold offers a 0.8% maker fee and a 1.5% taker fee. Deposits via debit/credit card and Google and Apple Pay are subject to a 3.99% fee. Withdrawals are free with a 0% fee with the exception of withdrawals to a debit card where the fee is 1.75%.

3) Kraken

Best crypto platform for experienced traders

Kraken stood out while reviewing various exchanges for its combination of high performance, institutional-grade security, and transparent fee structure. I advise anyone interested in serious crypto investing to consider Kraken’s staking and margin features. It offered me fast execution speeds and real-time market data, which are essential for any strategic trader. It is a great way to stay ahead without compromising on control. For example, financial advisors have been integrating Kraken into their asset management workflows to stay versatile in a tokenized economy.

Features:

- Margin Trading: Kraken offers margin trading with up to 5x leverage on selected pairs, giving traders the chance to amplify positions responsibly. This can boost returns but also comes with higher risk, especially in volatile markets. I’ve used it to hedge short-term trades during Bitcoin swings. I recommend starting with small amounts to test your comfort level before scaling up.

- Wide Asset Selection: With over 250 cryptocurrencies listed, Kraken gives users a wide selection of assets, from major coins to lesser-known altcoins. This variety is useful for building a diversified portfolio. When I explored DeFi projects last year, Kraken had many of the tokens I needed. That saved me from hopping between multiple platforms.

- Fiat Currency Support: Kraken makes it easy to deposit and withdraw in several fiat currencies, including USD, EUR, and JPY. This global fiat support helps users in Singapore avoid high conversion fees when funding their accounts. While using this feature one thing I noticed is that wire transfers clear faster when sent during weekday banking hours, which helps with timely trades.

- Educational Resources: Kraken’s Learn Center offers detailed articles, video explainers, and tutorials designed for users at all levels. It covers topics ranging from basic blockchain concepts to advanced trading tactics. I’ve personally used their staking guides, and they were clear and practical. It’s a strong foundation for anyone entering crypto seriously.

- Advanced Order Types: Traders on Kraken have access to various order types, such as stop-loss, take-profit, and conditional orders. These tools help automate risk management and improve entry or exit precision. There is also an option that lets you set expiration dates on conditional orders, which I found helpful during fast-moving markets.

- API Access: Kraken’s API is robust and well-documented, suitable for developers looking to automate trading strategies or run bots. I built a script to track price changes and execute trades based on volume spikes. That saved me from constantly monitoring charts manually. It also integrates well with third-party platforms like TradingView and Hummingbot.

- NFT Marketplace: Kraken recently launched its NFT platform, allowing users to trade, manage, and explore digital collectibles. Unlike many marketplaces, it supports both Ethereum and Solana networks, reducing friction. You will notice that gas fees are absorbed by Kraken for eligible collections, which keeps transaction costs lower. This makes it more beginner-friendly for NFT exploration.

Pros

Cons

Trading Fees:

Kraken’s taker fees start at 0.40% for lower trading volumes and can decrease significantly for higher trading volumes, potentially reaching as low as 0.000% for the highest volume tiers. This structure incentivizes traders to increase their trading volume to benefit from lower fees. Deposits are free, while withdrawals are set at 0.00002 BTC.

4) Zoomex

Best for Secure and Fast Crypto Trading

Zoomex offers a feature-rich environment that made my trading workflow faster and smoother. I particularly appreciate how well the interface adapts to both mobile and desktop. It allowed me to stay active even while traveling. Over the course of my evaluation, I found that its low-latency transactions and robust security made a noticeable difference in performance. This is a great option if you are looking for a reliable cryptocurrency exchange in Singapore. It is important to consider its high-speed engine if timing is critical to your trades. Financial advisors often favor Zoomex’s multi-asset support and fast execution speeds to efficiently manage diversified crypto portfolios on behalf of clients.

Features:

- No-KYC Trading: Zoomex allows users to trade cryptocurrencies without going through mandatory KYC verification. This appeals especially to privacy-conscious traders and those wanting quick access to the market. Setting up an account takes just minutes, letting you start trading right away. You will notice fewer barriers to entry, which is ideal if you’re testing strategies or exploring altcoins without full commitment.

- Dual Exchange Model: Zoomex supports both centralized and decentralized trading through a hybrid model. You get the convenience of a CEX with the autonomy of a DEX, making it easy to switch based on your risk appetite or market strategy. I’ve used the DEX mode when dealing with niche tokens that weren’t available on the CEX side. There is also an option that lets you route trades through liquidity pools automatically, which can sometimes result in better pricing.

- Express Purchase Option: You can buy crypto instantly with SGD or other fiat currencies, which cuts down on wait times and intermediate steps. It’s particularly useful for new traders who want to avoid the technicalities of wallet setups or external exchanges. I tested this feature with a Visa debit card, and the crypto landed in my wallet in under five minutes. I recommend using this for market dips when timing is critical.

- Trade Arena Prediction Market: This feature lets users participate in a gamified prediction market based on crypto price movements. Even with small investments, you can potentially earn outsized returns—up to 1000x. I experimented with this during a BTC earnings week and found the system intuitive and fast to settle. While using this feature one thing I noticed is that volatility plays a huge role—timing entries around major news events can significantly boost outcomes.

- DEX Smart Contract Integration: You can trade directly from your personal crypto wallet, thanks to Zoomex’s smart contract integration. This means your assets never leave your control until a transaction is confirmed. It’s a major trust-builder for experienced traders. I suggest linking a MetaMask wallet and testing smaller trades first to understand gas fees and contract behavior.

- User-Centric Development: Zoomex actively incorporates user feedback into its updates, which shows in the intuitive layout and fast rollout of new features. I was part of their beta feedback program in early 2024, and saw firsthand how a suggested tweak to order book filtering was implemented within two weeks. The tool lets you submit feedback directly from the dashboard, which creates a tighter loop between users and developers.

Pros

Cons

Trading Fees:

Zoomex’s Maker fee is 0.02% and Taker fee is 0.06%.

5) Binance

Best Crypto features in a Single Platform

Binance has been a top-rated option in my evaluation of exchanges for Singaporean crypto investors. I tested its staking and futures features extensively. The trading interface is smooth, and it helps you manage risk with built-in tools. I recommend Binance for its scalability—it is great for hobby investors and full-time traders alike. The temporary license from MAS is a major trust signal, showing it is keeping pace with local compliance needs. In my opinion, it is one of the easiest platforms to diversify assets while paying minimal fees. Retail investors often pick Binance to experiment with staking and yield farming, finding it a reliable and cost-efficient entry point into passive crypto income.

Features:

- Spot Trading: Binance delivers a powerful spot trading experience, offering access to over 400 cryptocurrencies. For users in Singapore, this breadth means opportunities to diversify portfolios beyond the typical top coins. I’ve personally used it for smaller altcoin trades and found the liquidity to be consistently reliable. While using this feature one thing I noticed is that setting up custom trading pairs in the advanced view gives better charting insights and precision.

- Binance Smart Chain: This blockchain network runs parallel to the Binance Chain, enabling smart contracts and decentralized applications. I’ve worked on DeFi projects that deployed on Binance Smart Chain (BSC) due to its lower fees and faster confirmation times. The tool lets you switch between testnet and mainnet easily through MetaMask, which helps a lot when experimenting with smart contract deployments. BSC continues to be a cost-effective choice for developers and users alike.

- Binance Earn: Singaporean users can grow their crypto assets passively with Binance Earn. It includes flexible and locked staking, savings products, and liquidity farming. I used the locked staking option for BNB and saw steady returns over 30 days. I recommend setting calendar reminders for unlock dates to avoid missed opportunities or unnecessary auto-renewals.

- Localized Services: Binance provides tailored services for Singapore, such as compatibility with local banks and compliance with MAS guidelines. When I used Binance in Singapore, linking my account with local payment methods made deposits and withdrawals smooth and quick. The platform also adapts to regional regulatory updates, ensuring users stay compliant without extra hassle.

- Trust Wallet Integration: Binance integrates seamlessly with Trust Wallet, which supports a wide range of tokens. I used Trust Wallet to access DeFi platforms directly from my phone without exposing my private keys to exchanges. There is also an option that lets you enable biometric security, which I suggest activating for an extra layer of protection on mobile.

- Launchpad: The Binance Launchpad offers early access to new tokens with strong growth potential. I once participated in a token sale that later gained over 500%—a reminder of how valuable early entry can be. Launchpad eligibility often depends on holding BNB, encouraging long-term engagement with the ecosystem.

- Regulatory Compliance: Binance has strengthened its global and regional compliance, which is especially important in a tightly regulated market like Singapore. I noticed improvements in the KYC process over time, making verification quicker and more secure. These steps build trust, especially for users new to crypto investing.

Pros

Cons

Trading Fees:

Deposits are free, withdrawals incur a fiat fee based on blockchain network commission, and account opening at no cost

Link: https://www.binance.com/en

6) Zipmex

Best Customer Support

Zipmex delivers a top-notch solution for those looking to balance crypto trading with earning potential. I evaluated this platform while reviewing Singapore’s top exchanges and found it ideal for mobile-first users. I particularly appreciate the way Zipmex integrates savings-like interest features into its exchange platform. The ZMT token not only supports the ecosystem but also gives practical cost benefits. It might be helpful to know that even casual investors can maximize returns by simply locking tokens or holding their assets on-platform.

Features:

- High Liquidity: Binance maintains consistently high liquidity, which supports fast order execution across a wide range of trading pairs. This is especially valuable during periods of market volatility. I’ve executed trades at peak hours and still experienced minimal slippage. You will notice that using limit orders during high-liquidity windows often secures better entry points.

- ZMT Token Benefits: Although Binance primarily promotes BNB, Singapore users trading through Zipmex may still benefit from ZMT token perks if they manage multiple exchanges. Holding ZMT can lower trading fees and unlock access to partner campaigns. I suggest tracking token-holding thresholds, as they directly impact the fee tier benefits you’ll receive. The incentives grow the longer you stay invested.

- ZipUp+ Program: ZipUp+ offers a straightforward way to earn interest on idle crypto balances. When I tested this with stablecoins like USDC, I received consistent returns without having to lock funds. The flexible terms make it appealing for newer users. There is also an option that lets you auto-subscribe deposits, which is great for maximizing compounding without manual intervention.

- ZLaunch Platform: The ZLaunch platform gives users access to promising early-stage crypto projects. I participated in one launch event that offered bonus rewards based on the amount staked. These launches often draw significant attention, making timing crucial. While testing this feature, I found that joining on the first day of the campaign yields better allocation chances.

- Mobile Application: Binance’s mobile app offers full trading, staking, and wallet features right from your phone. I’ve used it during travel in Southeast Asia and was impressed by its stability and speed. Chart tools are intuitive, even for quick technical analysis. The biometric login also adds a solid layer of convenience and security.

- Robust Security Measures: Binance applies multi-layered security protocols, including 2FA, wallet whitelisting, and AI-powered risk alerts. These have personally helped me flag suspicious login attempts early on. The platform also offers account activity logs, which I routinely check. This level of transparency and protection builds user confidence.

- Zipmex Card: The Zipmex Card turns your crypto into a spendable currency, working seamlessly with merchants that accept Mastercard. I used it for small purchases in Singapore and received cashback in crypto. I recommend linking the card to your most liquid asset, like USDT, to avoid conversion delays or sudden value drops. It’s a smart way to bridge digital and real-world finance.

Pros

Cons

Trading Fees:

While making deposits on Zipmex, users are not charged any fee. However, for withdrawals, the platform imposes a starting fee of 0.0002 BTC. This structure ensures transparency and affordability for its users.

Link: https://www.zipmex.com/

7) Coinhako

Best for trading Bitcoin

Coinhako is what I would recommend to those who want a dependable and user-friendly crypto trading experience. As I carried out my evaluation, the most remarkable aspect was its support for local banks, which makes fiat-to-crypto transactions almost effortless. I found that it handles compliance and security very seriously. It offered me all the essential features I needed, without overloading the dashboard. This makes it ideal for anyone who wants simplicity and power combined in a cryptocurrency exchange. Startup founders in Singapore often choose Coinhako for its local support and fast SGD transactions, which makes treasury management faster and more secure.

Features:

- SGD and USD Support: Coinhako makes it easy for Singapore-based users to trade in both SGD and USD. This dual currency support eliminates the need for third-party conversions, saving time and fees. I’ve used it to switch between local and global markets without hassle. I suggest linking a local bank account for SGD deposits to speed up fund transfers and avoid hidden charges.

- Recurring Buy Feature: This feature helps users automate crypto purchases on a daily, weekly, or monthly basis. I’ve used it to build a long-term position in Ethereum without worrying about timing the market. It’s a great tool for dollar-cost averaging. While testing this feature, I found setting it to run right after payday helps maintain consistency without affecting monthly budgeting.

- Real-Time Price Alerts: Coinhako allows you to set personalized price alerts for various cryptocurrencies. I’ve used these alerts to catch sudden price dips, which helped me make fast buying decisions. Alerts can be configured through the app or email. There is also an option that lets you customize alert thresholds by percentage changes, which is helpful for tracking smaller-cap assets.

- Reward Program: Coinhako’s loyalty program rewards you for regular activity like trades and referrals. I accumulated points over three months and redeemed them for fee discounts. These rewards help offset costs for active users. The more you use the platform, the more benefits you unlock, which adds value over time.

- Secure Wallet Services: Security is one of Coinhako’s strong suits, with features like cold storage, 2FA, and withdrawal whitelists. I’ve tested the withdrawal process and noticed there’s an added verification layer that gives peace of mind. I recommend enabling email and mobile verification together for stronger protection against unauthorized access.

- OTC Trading Services: Coinhako offers tailored over-the-counter services for users making high-volume trades. I used this when helping a client execute a large BTC buy without impacting market prices. The support team was responsive and handled settlement quickly. OTC services are ideal for institutions or high-net-worth individuals needing discretion and efficiency.

- Integration with Google Cloud: By leveraging Google Cloud infrastructure, Coinhako ensures high uptime, quick response times, and strong data protection. This backend reliability is evident in how smoothly the platform operates, even during heavy traffic periods. You will notice faster load speeds and reduced transaction lag, especially during peak market hours.

Pros

Cons

Trading Fees:

Deposits are complimentary, withdrawals incur a $2 base fee for Singapore transactions and start from 2% elsewhere, while account opening is entirely free.

Link: https://www.coinhako.com/

Find Your Perfect Crypto Wallet

Not sure where to start? Answer 5 simple questions, and we’ll recommend the ideal crypto wallet or exchange that matches your needs, whether you’re a long-term investor, a daily user, or a savvy trader.

Which Crypto Wallet/Exchange is Right for You?

Answer these five questions to find the perfect crypto wallet/exchange.

Your Recommended Wallet:

What is the Best Way to Buy Bitcoin in Singapore?

The best way to Buy Bitcoin in Singapore is by using credible crypto exchanges that support SGD (Singapore dollars) as payment.

A local cryptocurrency exchange platform is often preferred because:

- The Monetary Authority of Singapore (MAS) has most likely granted it permission to operate as a digital payment token service provider in Singapore.

- The best bitcoin exchanges exchange likely complies with Anti Money Laundering (AML) reporting obligations.

- One can directly buy or sell bitcoin using Singapore dollars.

- You can also pay with other local payment options, such as credit or debit cards or bank wire transfers.

- If you have any issues, you can easily contact the local customer care service for help

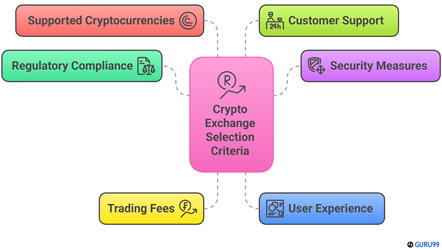

How Did We Choose Best Crypto Exchange in Singapore?

At Guru99, we are committed to delivering credible, objective, and accurate content. Our team spent over 110 hours comparing 55+ platforms to identify secure, scalable, and user-centric crypto exchanges in Singapore. Each recommendation includes verified features, pricing, and reliability to support informed decisions. We have prioritized exchanges that meet regulatory standards, offer high liquidity, and provide strong customer support. Our selections aim to guide both new and experienced traders with consistently updated, trustworthy data. Ensuring relevance, usefulness, and transparency, we focus on the following factors while reviewing a tool based on security, compliance, performance, and user experience.

- Regulatory Compliance: We chose based on MAS licensing to ensure operations align with Singapore’s strict financial regulations.

- Security Measures: Our team chose platforms with multi-layered protection and cold storage for reliable user asset security.

- Trading Fees: We made sure to shortlist exchanges offering competitive fees with no hidden charges to maintain transparency.

- User Experience: The experts in our team selected the tools based on intuitive design and ease of navigation for all users.

- Supported Cryptocurrencies: We chose exchanges that support major coins and altcoins, making trading versatile and user-centric.

- Customer Support: Our team considered platforms offering responsive, 24/7 support to resolve issues rapidly and smoothly.

Verdict:

In this review, you got acquainted with some of the top-rated crypto platforms for Singapore-based traders. Each offers secure, reliable, and customizable features. Zengo excels in security, Uphold is great for diverse assets, and Kraken suits advanced trading needs. I recommend choosing based on your priorities and trading goals.

- Zengo: A secure, user-friendly, and keyless non-custodial wallet with customizable network fees and built-in Web3 security, making it a superior choice for on-the-go users.

- Uphold: Ideal if you want a cost-effective way to diversify, trade across multiple asset classes, and benefit from a transparent, 100% reserved model.

- Kraken: Offers a robust trading environment for experienced users, complete with low fees, advanced tools, and a secure infrastructure to solve problems related to high-volume crypto operations.

FAQs

Zengo is the most secure non-custodial wallet in Web3 by removing the private key vulnerability, making it the simplest yet most secure wallet to invest in cryptocurrency.